Coordinating the dispatch of power across the national electricity market

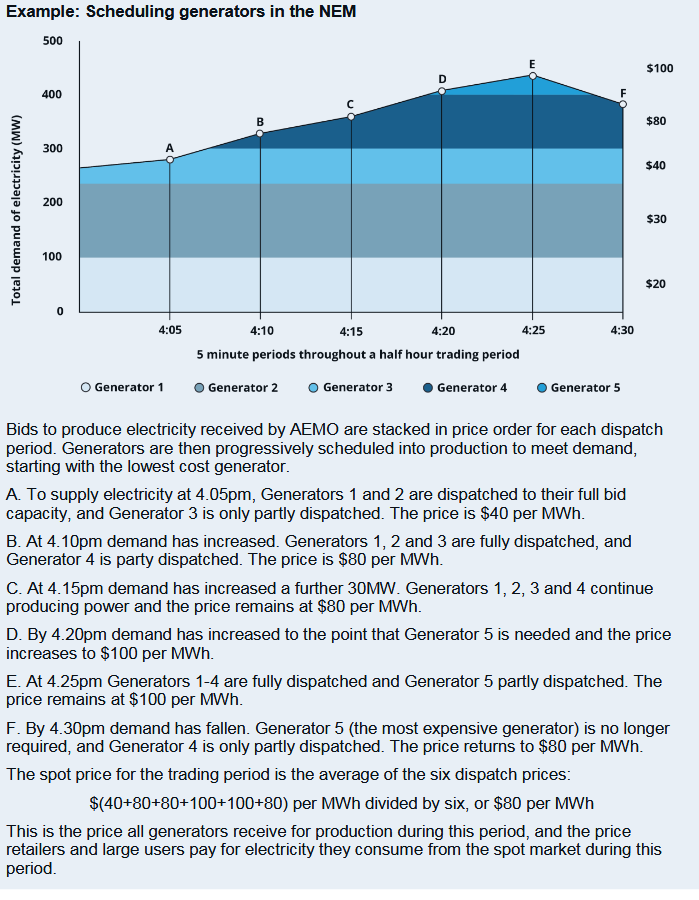

Generators submit the price and quantity of electricity that they are willing to generate to the system operator, AEMO.

AEMO’s central dispatch engine orders the generators’ offers, from least to most expensive, and determines which generators will be dispatched. Its objective is to dispatch the lowest cost mix of generators to meet expected demand.

AEMO runs the dispatch engine every five minutes so generators are required to bid to supply electricity in five minute blocks. For the purposes of settlement, the five-minute dispatch prices are averaged every 30 minutes to form a wholesale market ('spot') price.

All electricity generation in each 30 minute period receives the spot price for that trading interval.

Moving to five minute settlement

The AEMC has made a rule to change the settlement interval for the electricity spot price from 30 minutes to five minutes, starting in September 2021. Five-minute settlement provides a more accurate signal of the value of investing in fast response technologies, such as batteries, new generation gas peaker plants and demand response.

Regions and interconnectors

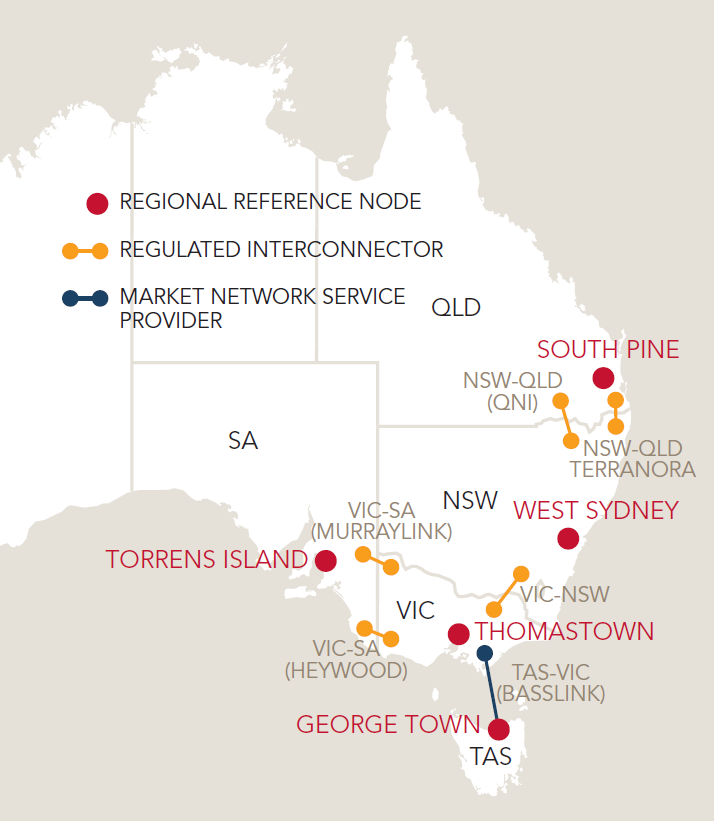

The national electricity market is a five regions (South Australia, Melbourne, Tasmania, New South Wales, Queensland) with:

- interconnectors (transmission links) which join the regions

- regional reference nodes (RRNs) at the largest load centre of each region.

Spot prices are calculated at each regional reference node. The spot price at a regional reference node can be set by generation within the region or in another region.

Electricity moves across regions through interconnectors which connect adjacent regions. Interconnectors deliver energy from lower price regions to higher price regions and will often equalise prices between regions.

However, when interconnectors are operating at full capacity, electricity will still be transported from a lower price region and sold in a higher price region but spot prices will separate.

Interconnectors can be a partial substitute for local generation in a region to the extent they can import electricity making them an alternative to increasing the capital stock of generation within a region.