Electricity networks - the poles and wires - are made up of transmission and distribution networks. Transmission networks transport electricity at high voltages from a range of generators to major demand centres. Distribution networks in turn transport electricity from transmission networks at lower voltages to end-use customers.

Transmission network service providers (TNSPs) build, maintain, plan and operate the network transmission networks in the national electricity market. Distribution network service providers (DNSP) build, maintain and operate the distribution networks.

The National Electricity Rules set out a national framework for transmission and distribution network planning and expansion. The national framework consists of an annual planning, decision-making and reporting process. as well as a detailed cost-benefit analysis of particular projects.

Transmission network planning

A huge amount of generation will be built in the coming years, taking the place of ageing coal-fired power. AEMO, the system planner, forecasts the overall transmission system requirements to connect new generators and reliably supply consumers over the next 20 years in its Integrated System Plan.

Overview of transmission planning process

The national framework for transmission network planning is designed to facilitate new and replacement transmission assets at the least cost to consumers. In consultation with stakeholders:

- AEMO, the system planner, provides a system-wide overview about what is needed and when in its Integrated System Plan (this replaces the National Transmission Network Development Plan, which was previously published annually by AEMO). The Integrated System Plan is developed in consultation with transmission businesses, as well as the broader industry.

- transmission businesses, drawing on their local knowledge, choose the best project to meet the network need identified in the Integrated System Plan. This project must undergo a cost-benefit assessment (the regulatory investment test for transmission or RIT-T) that includes considering if non-network solutions like demand response may be more efficient.

- Australian Energy Regulator (AER) approves the RIT-T and sets network prices so customers are only paying for investment that is efficient

- AEMC, the rule maker, designs the regulatory framework so responsibilities are clear and risks allocated to the right people.

In addition to the Integrated System Plan, AEMO publishes the:

- Electricity Statement of Opportunities - an assessment of supply adequacy in the NEM over the next 10 years, highlighting opportunities for generation and demand-side investment

- NEM constraint reports - details on interconnector capacity and constraints in the transmission network.

Each region of the national electricity market has a jurisdictional transmission planning body:

- NSW and ACT - TransGrid

- Queensland – Powerlink

- South Australia – ElectraNet

- Tasmania - Transend

- Victoria - AEMO (in its role as Victorian transmission network service provider).

The jurisdictional planning bodies produce Annual Planning Reports which:

- draw upon the high-level Integrated System Plan, but detail more specific investment needs and drivers

- contain details of potential network investments, given forecast loads

- under the National Electricity Rules (NER)

- must cover at least the next 10 years, but there is typically an emphasis on the next 2-3 years

- for demand must include

- forecast loads submitted by a Distribution Network Service Provider

- proposals for future connection points

- for constraints must include information relating to constraints in their network, and associated network developments

- for proposed network agreements:

- for all proposed augmentations must include:

- brief description of project

- reason for augmentation

- proposed solution

- total cost of solution

- how it relates to the Integrated System Plan.

- for all replacement expenditure must include

- brief description of project

- date it will become operational

- purpose of asset

- total cost of assets.

- for all proposed augmentations must include:

Project-specific planning for transmission assets

Project specific planning relates to a particular investment need, and culminates in a particular investment decision. There is a separate and distinct process for individual investment decisions, specifically the application of either the:

- regulatory investment test for transmission (RIT-T) – this is applied for all investments, including replacement projects, greater than $8 million in value

- non RIT-T assessments – all other assets ($8 million or less in value).

In both of these processes, a detailed cost-benefit assessment is undertaken to identify the investment option that has the highest net benefits. Based on these assessments the transmission business then makes the investment decision.

Regulatory investment test for transmission

Under the National Electricity Rules, the AER must publish the RIT-T. The AER must also develop and publish RIT-T application guidelines to provide guidance on the operation and application of the RIT-T.

The purpose of the RIT-T is to identify the transmission investment option which maximises net economic benefits and, where applicable, meets the relevant jurisdictional or NER based reliability standards.

Transmission businesses:

- must plan and develop their network to meet reliability standards (i.e. minimise costs)

- can also undertake investment where that investment would result in a net market benefit, but is not necessarily designed to meet a specific reliability requirement.

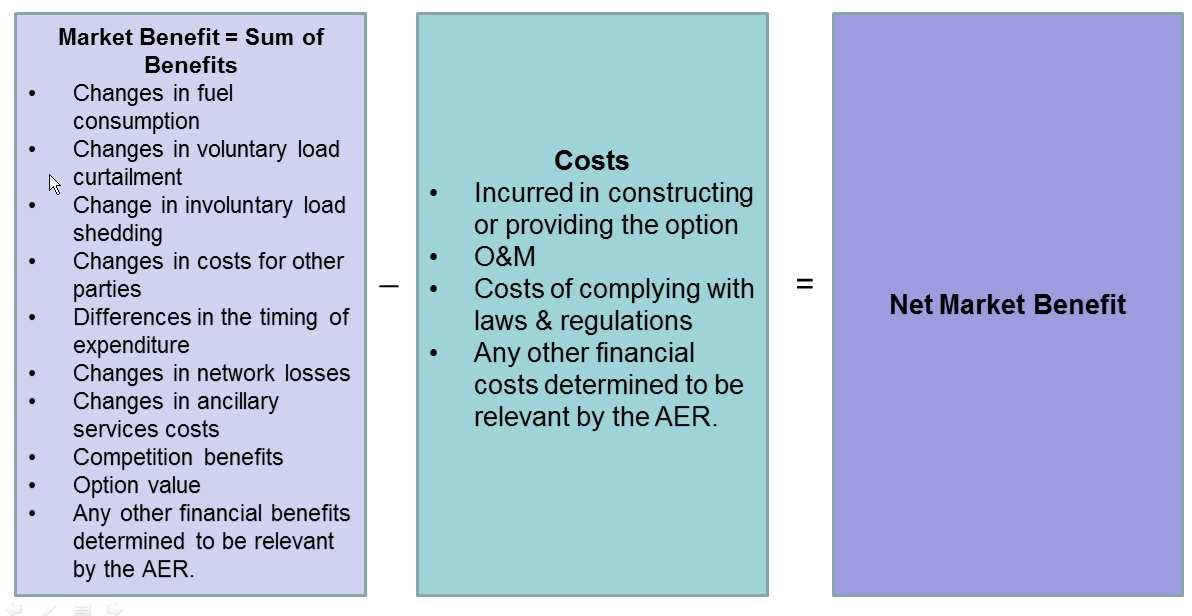

Investments to meet the RIT-T must maximise the net market benefit.

Distribution network planning

The national framework establishes a nationally consistent annual planning and reporting cycle and project assessment process for distribution networks. It consists of:

- Distribution network annual planning and reporting process:

- Distribution annual planning review

- Distribution annual planning report (DAPR)

- Demand side engagement obligations

- Distribution investment project assessment process:

- Regulatory investment test for distribution (RIT-D)

- Dispute resolution process

Distribution annual planning review

Each distribution network service provider (DNSP) is required to undertake an annual planning process covering a minimum forward planning period of five years for its distribution assets (and ten years for dual function assets).

The forward, minimum five year, period commences on a date deemed appropriate by each DNSP.

The planning process applies to distribution network assets and activities undertaken by DNSPs that would be expected to have a material impact on the distribution network in the forward planning period.

In carrying out the planning process, DNSPs are, at a minimum, required to:

- prepare forecasts of maximum demands for the relevant network assets;

- identify (based on those forecasts) system limitations; and

- take into account non-network options when considering investment options.

Distribution annual planning report

DNSPs must publish a Distribution annual planning report (DAPR) setting out the results of the distribution annual planning review for the forward planning period. DNSPs must publish their DAPR by the date specified in jurisdictional electricity legislation or, if no such date is specified, by 31 December. The DAPR must include the information specified in the NER (schedule 5.8 ) .

Demand side engagement obligations

DNSPs must develop a demand side engagement strategy which sets out the strategy for engaging with non-network providers and considering non-network options for addressing system limitations.

DNSPs must document their demand side engagement strategy in a demand side engagement document which

- has content requirements specified in NER (schedule 5.9)

- is published by no later than 31 August 2013

- is reviewed and revised at least once every three years.

DNSPs must establish and maintain a demand side engagement facility by which parties can register their interest in being notified of developments related to distribution network planning and expansion .

Regulatory investment test for distribution

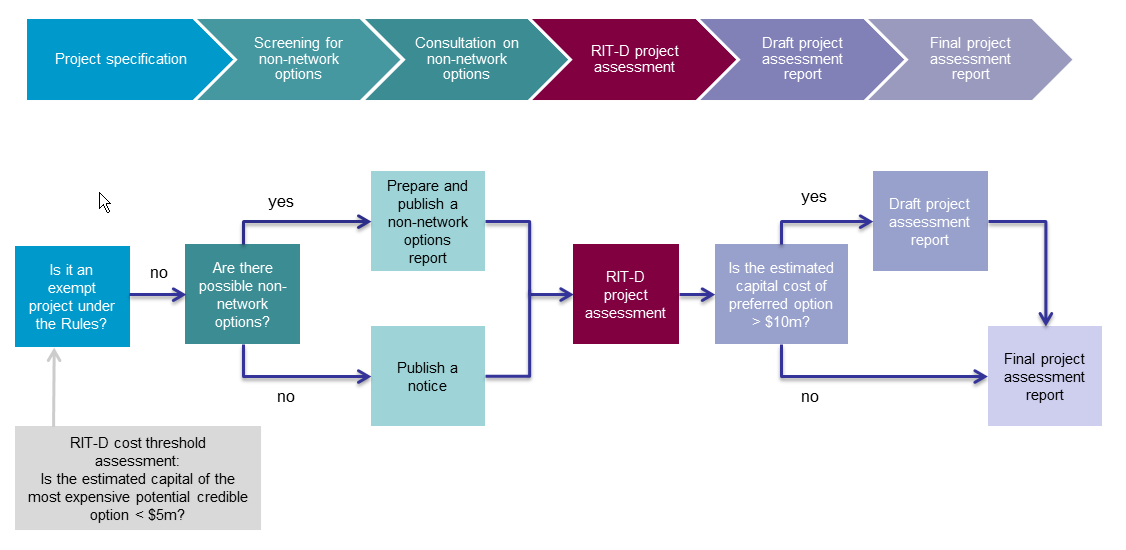

The regulatory investment test for distribution (RIT-D) has two key components:

- A cost benefit test

- Procedures (project assessment process) which includes

- project specification

- exempt projects

- cost threshold assessment (>$5m).

- screening for non-network options.

- project specification

The non-networks options report consultation includes:

- application of the RIT-D which includes a:

- draft project assessment report consultation

- final project assessment report.

The RIT-D establishes the processes and criteria to be applied by DNSPs in order to identify investment options which best address the needs of the network. It is applicable in circumstances where a network problem exists and the estimated capital cost of the most expensive potential credible option to address the identified need is more than $5 million.

Certain types of projects and expenditure are exempt from the RIT-D, including projects initiated to address urgent and unforeseen network issues.

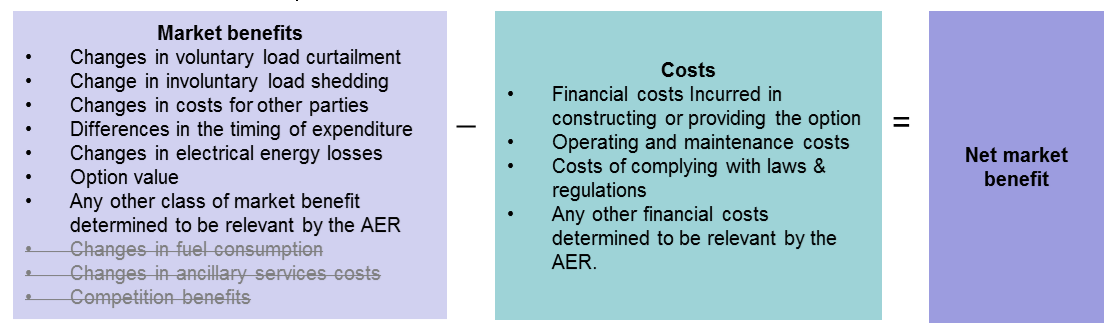

In summary, the RIT-D requires DNSPs to assess the costs and, where appropriate, the benefits of each credible investment option to address a specific network problem to identify the option which maximises net market benefits (or minimises costs where the investment is required to meet reliability standards).

Under the RIT-D, the quantification of market benefits is optional. The NER states that a DNSP may quantify each class of market benefits where it considers that:

- any applicable market benefits may be material; or

- the quantification of market benefits may alter the selection of the preferred option.

However, where a project is not driven by reliability corrective action, a DNSP would need to quantify both the applicable costs and market benefits in order for the preferred option to have a positive net market benefit.

Dispute resolution process

The National Electricity Rules include a dispute resolution process that is open to all projects subject to the RIT-T or RIT-D.

Relevant parties are able to raise disputes with the AER in relation to the conclusions made by the proponent in a final project assessment report, on the grounds that:

- the proponent has not applied the RIT in accordance with the Rules; or

- there was a manifest error in the calculations performed by the network business in applying the RIT.

The AER may then either reject a dispute, or make a determination on the dispute, and the timeframes for doing so will depend on the complexity of the dispute.

The AER may only make a determination which directs a business to amend its final project assessment report where the business has not correctly applied the RIT in accordance with the rules, or where the business has made a manifest error in its calculations.

Joint planning arrangements

There are a number of joint planning arrangements under the National Electricity Rules:

- Transmission businesses are required to undertake joint planning with other transmission businesses, with these arrangements being fairly light touch.

- Transmission businesses and distribution businesses also have joint planning arrangements that are fairly prescriptive. Under TNSP-DNSP joint planning, the TNSP must conduct the RIT-T for projects identified under the joint planning process, in conjunction with the relevant DNSP. The RIT-T requires a broader range of market benefits be assessed, thus ensuring any applicable market benefits are appropriately considered.

- Distribution businesses are required to undertake joint planning with the owners of any connected networks where there are issues affecting multiple networks. These DNSP-DNSP joint planning obligations are less prescriptive than the equivalent arrangements for TNSP-DNSP joint planning. Under DNSP-DNSP joint planning, DNSPs must carry out the requirements of the RIT-D for projects identified under the joint planning process.