Keynote address on designing 21st century markets (edited)

Tim Nelson Executive, General Manager Strategy and Economic Analysis of

Australian Energy Market Commission at

Energy Users Association of Australia national conference - 1 May 2019

MR NELSON: Thank you and yes I've been with the AEMC now for about five months, and my riding instructions for today are to give you a bit of an overview of where we've come from, just a bit of a refresher, and also some of the current issues that we're currently seeing in the market. First a quick reminder about what the AEMC is here to do. So the AEMC is the rule maker for Australian electricity and gas markets. It's effectively a delegated law maker, and that's a very significant responsibility which the commission takes very seriously.

We make and amend the national electricity rules, national gas rules and national energy retail rules. And the fourth pillar of what we do is provide market development advice to governments. It's very important that we're there providing the best advice possible in this broad context of energy market reform and the significant economic transformation that's under way.

So I guess a bit of a refresher on the national electricity market. It's no accident that we ended up where we've got to with the NEM in the sense that it was a very deliberate, micro economic reform introduced in the 1990s, designed to introduce competition where possible into the electricity and the gas supply chains, and I'll just put a couple of dot points there against each of the components of generation of retail and networks, and I'll just unpack them just very briefly.

Significant reform implemented between 1995-2010: Overarching principle to allocate economic risks to those best placed to manage them ie market participants not consumers

Generation

- Gross energy-only pool market created allocative efficiency

- Derivative market evolved to facilitate risk management

- Provides an explicit price for the value of capacity

- Reliability proportionally rewarded and penalised.

Retail

- Full retail competition introduced gradually from 2002

- Price deregulation occurred when competition was deemed effective by the AEMC under the Australian Energy Market Agreement

Networks

- Overarching principle was to allocate economic risks to those best placed to manage them (eg market participants not consumers).

The idea behind creating a gross energy only pool was to try and drive allocative efficiency, ensuring that the cheapest resources get allocated in the bid stack, first - lowering overall costs for consumers.

One of the fundamental missing points in a lot of the public commentary is the role of the derivative markets which is overlaid on top of the spot market.

The derivative and associated markets are really there to provide risk management services so that retailers, generators and other market intermediaries are able to manage the significant price risk that manifests as a result of changing demand profiles at various times of the day and various points of the year.

One of the other things I think is really important to note is that an energy-only gross pool provides an explicit price to capacity in the form of contracts and also proportionately rewards and penalises reliability in the sense that at those very high price events if I've sold forward contracts and I can't make good on that promise, then effectively I am proportionally penalised relative to a period of relatively low electricity demand.

On the retail side we've gradually introduced full retail competition since the early part of last decade. A critical point is that price deregulation only occurred when competition was found to be effective.

On the network side of things, networks have always been economically regulated because of their monopolistic characteristics.

And an overarching principle right through the micro-economic reform of all industry sectors was to use market principles to ensure risks, benefits, and costs, were effectively allocated to market participants that were best placed to manage those them – instead of putting that burden on taxpayers or consumers.

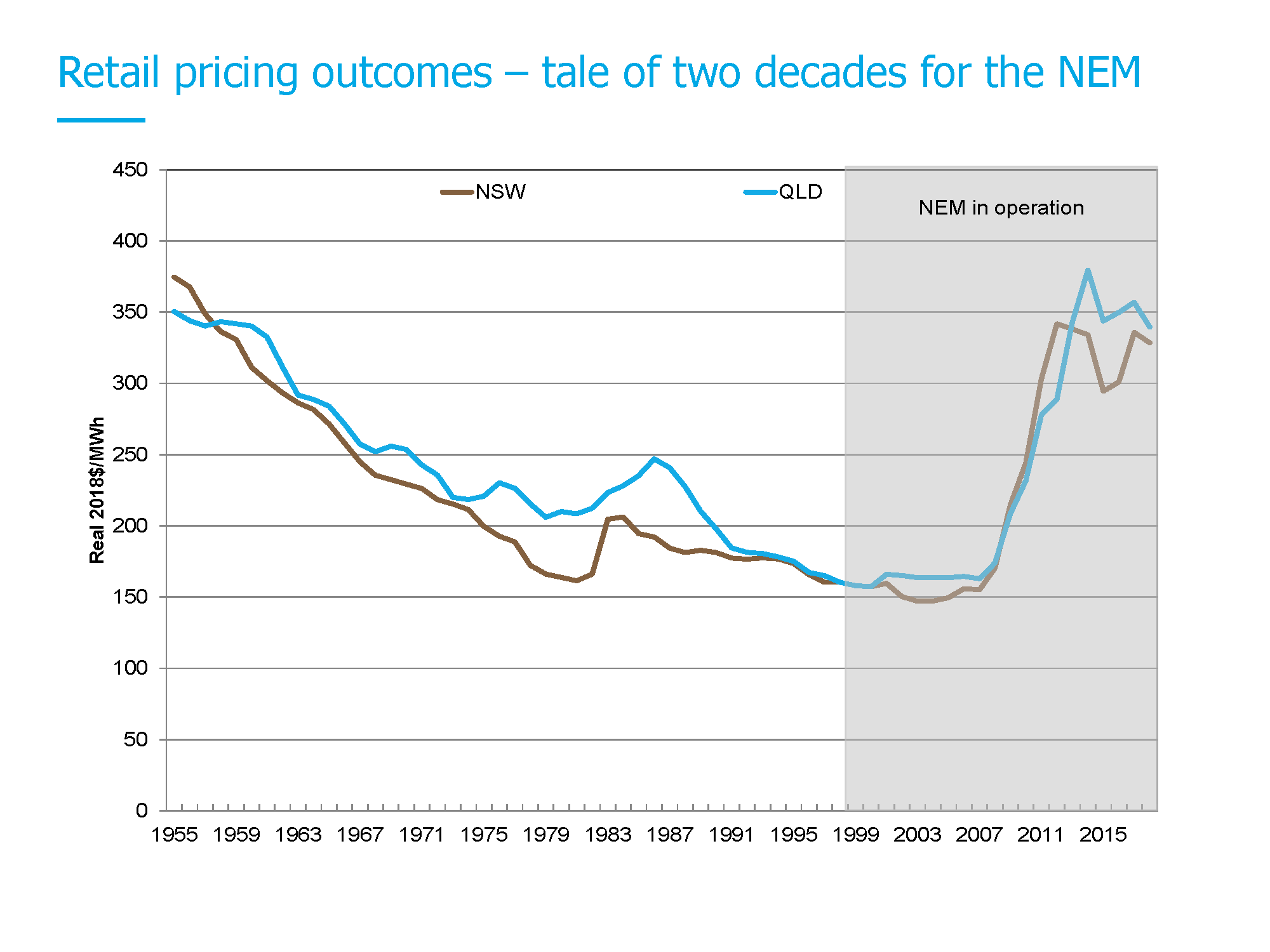

Retail pricing outcomes is a tale of two decades. This chart shows a very, very long electricity price trace all the way back several decades, but the area on the right-hand side of that chart has been shaded just to show what the tale of two decades and the national electricity market looked like.

The first decade was effectively a decade of real electricity price decline, and then you've seen quite a significant price increase in the last decade.

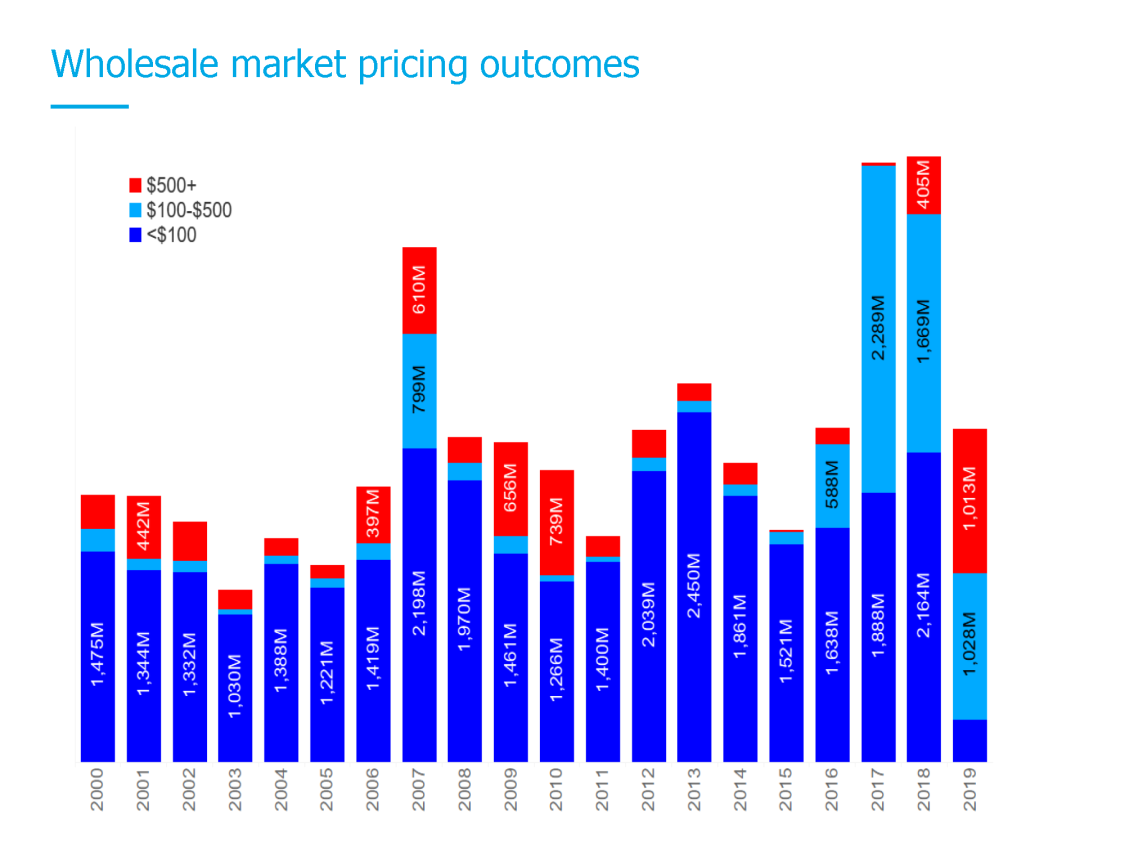

In terms of wholesale market pricing outcomes, what I think is most important to note about this particular chart is the emergence of those light blue and red bars on the right-hand side. I'll just take a moment to unpack that.

What it's showing is the total value traded through the pool in each of those calendar years, broken down by pricing segments with under $100 and then those peaking pricing outcomes shaded in red. You'll see in the last few years it's not just the average underlying value that's gone up. It's also the proportion that's been traded through in those higher price bands.

And in 2019 you can see that the value of energy that's traded through that pool is as high as in calendar years previously. So we've certainly seen prices increase as a result of a very tight supply/demand dynamic.

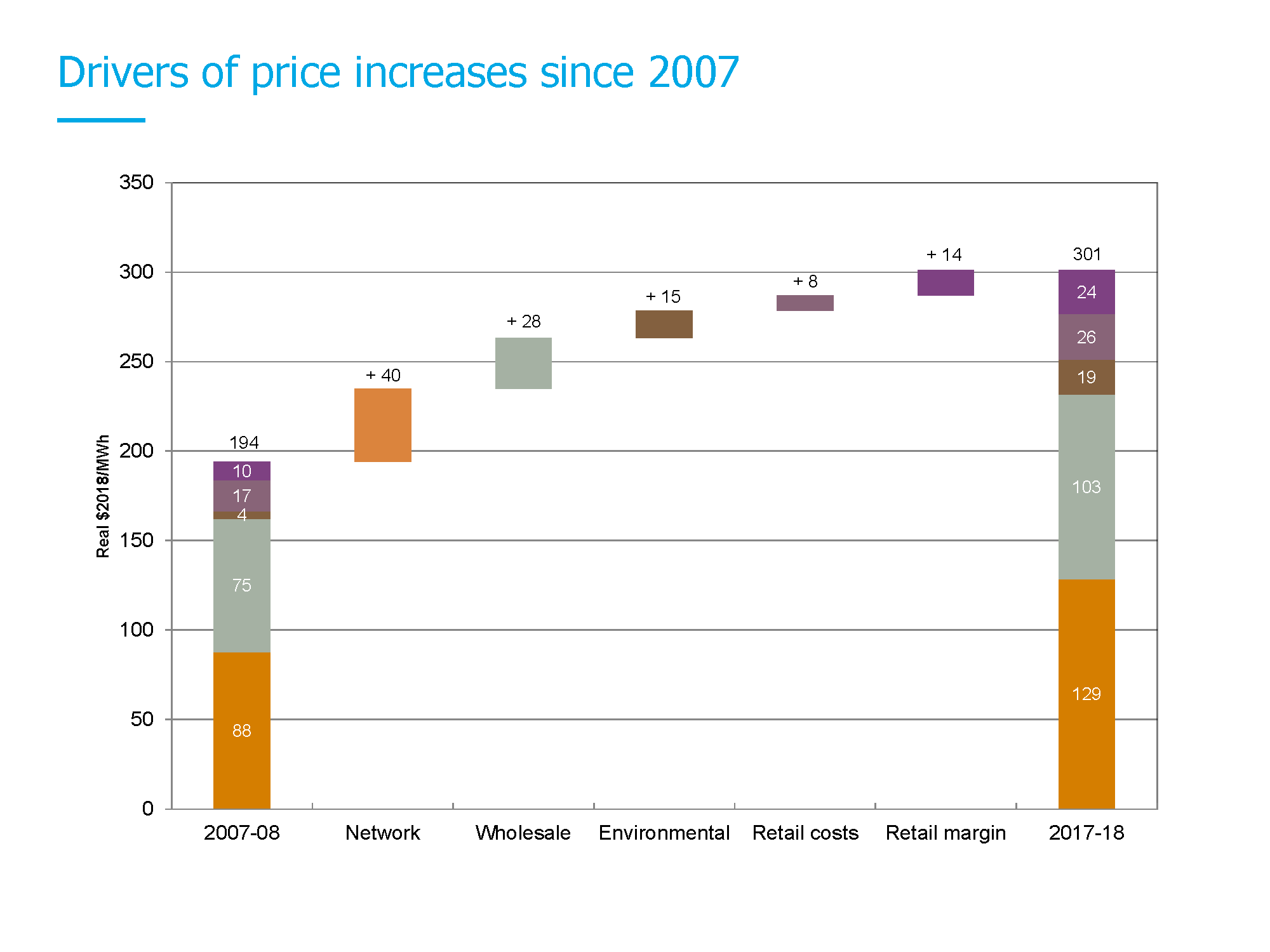

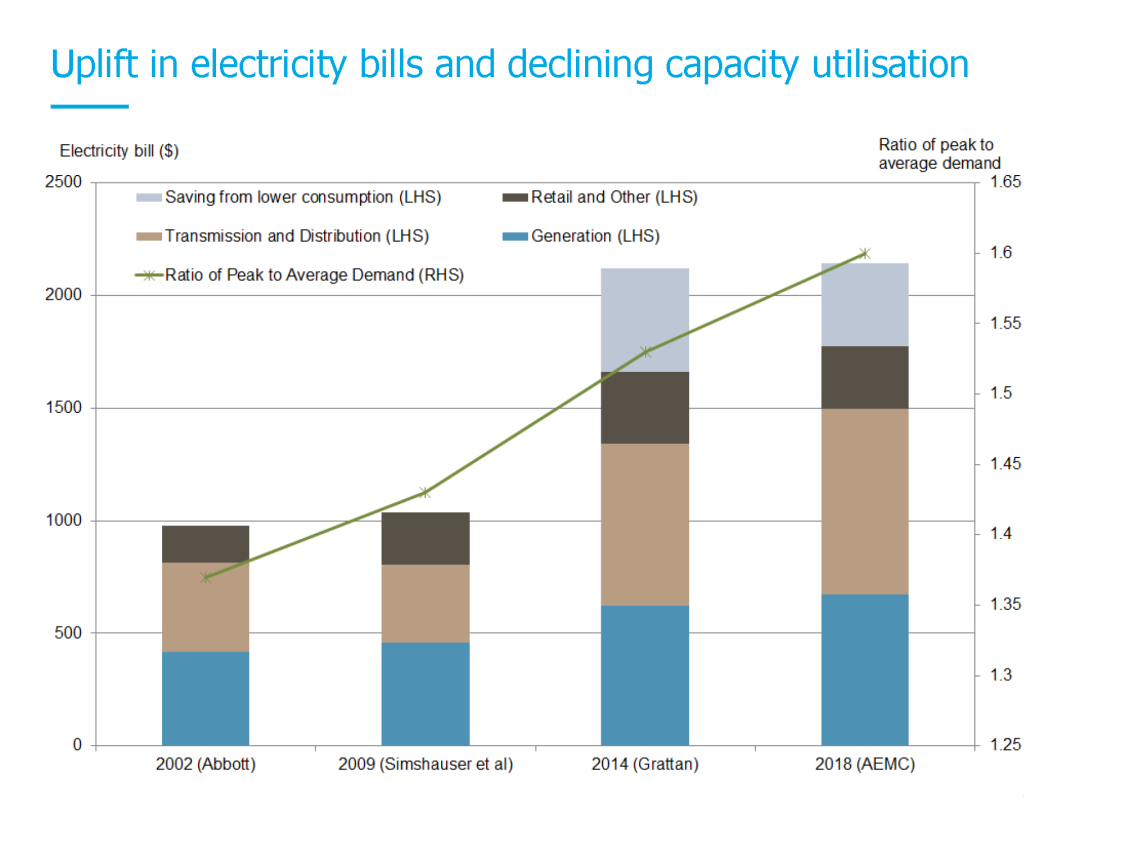

Let’s take a moment to understand where prices have increased in that second decade of the national electricity market. You can see two primary buckets of cost increases, one being network, one being wholesale. I'll provide a perspective on what's gone on there.

First, just in terms of pricing outcomes, if you go back in time, you can see that in 2002 through to 2009, prices from a real households bill perspective, you can see the real bill is roughly the same, but by the time that you get through to the middle part of this decade and then today, a couple of factors can be noted.

You've got quite significant increases in networks and wholesale but you've also got a very significant decline in capacity utilisation, and that basically increases the total average cost to serve.

Now, the light grey bars on top are really interesting. What they show is that bills would have been even higher had it not been for households and businesses reducing their electricity consumption.

So why are prices now higher in terms of networks and wholesale markets?

In terms of networks, it is worth reminding ourselves that following the reliability events in the early 2000s we saw policy-makers sought to tighten standards, and what those standards being tightened meant is that there was a significant run-up in capital expenditure.

At the same time you had consumers being charged for the energy that they were paying for as opposed to the capacity that they required and we saw localised peak demand continue to grow.

Two million households then went and put solar PV on their roof, significantly reducing the amount of energy that they were consuming, and as a consequence of that we saw capacity utilisation rates fell.

On the wholesale side, really I think what we've seen is just a lack of integrated climate policy and reliance on production subsidies.

Production subsidies introduce more supply, but they don't provide an explicit pricing signal for, a more orderly substitution. The other thing production subsidies do is break the link between the physical needs of the system and the way in which contracts are used to bring new generation into the market. That's something which is often misunderstood in commentary around subsidies.

Now some comments on current issues in the market today. Security being one, followed by wholesale markets and then behind the meter.

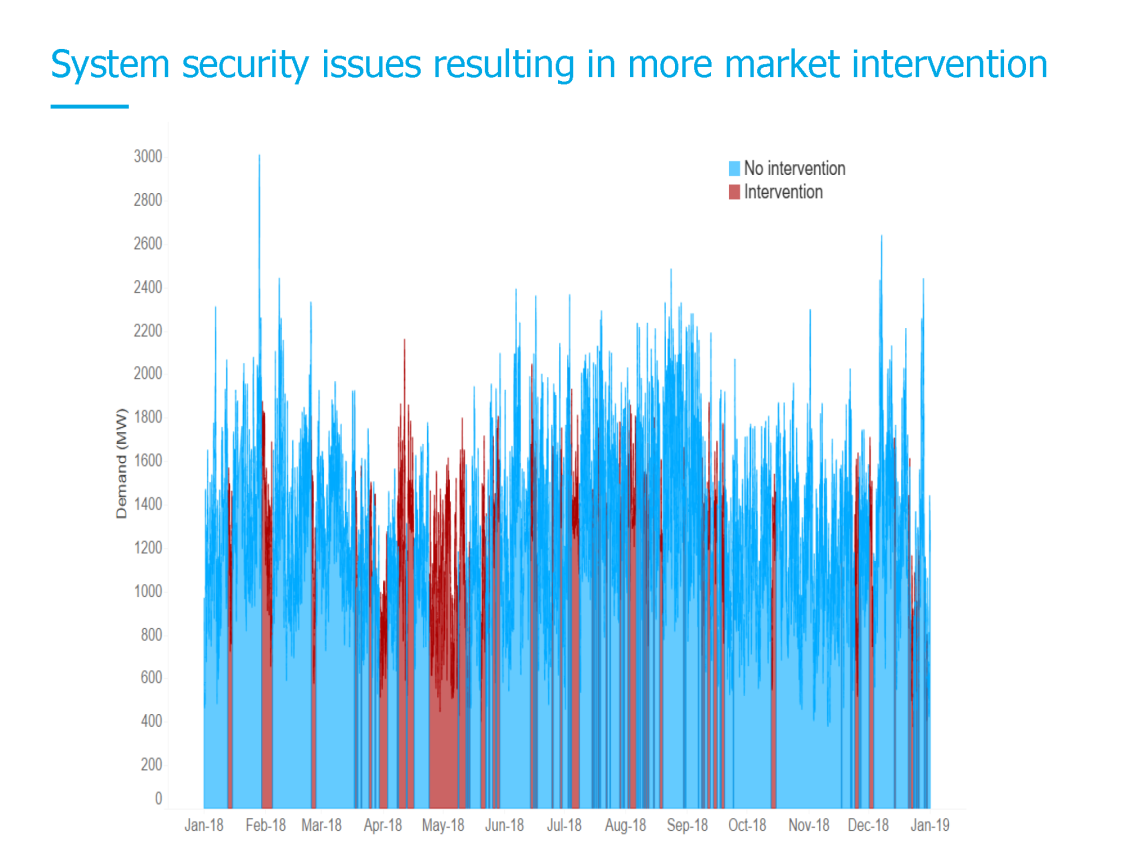

The AEMC and the Reliability Panel in recent weeks have reported widely on system security issues that are resulting in more market intervention.

It is a characteristic of the way in which the economic transformation of this market is occurring.

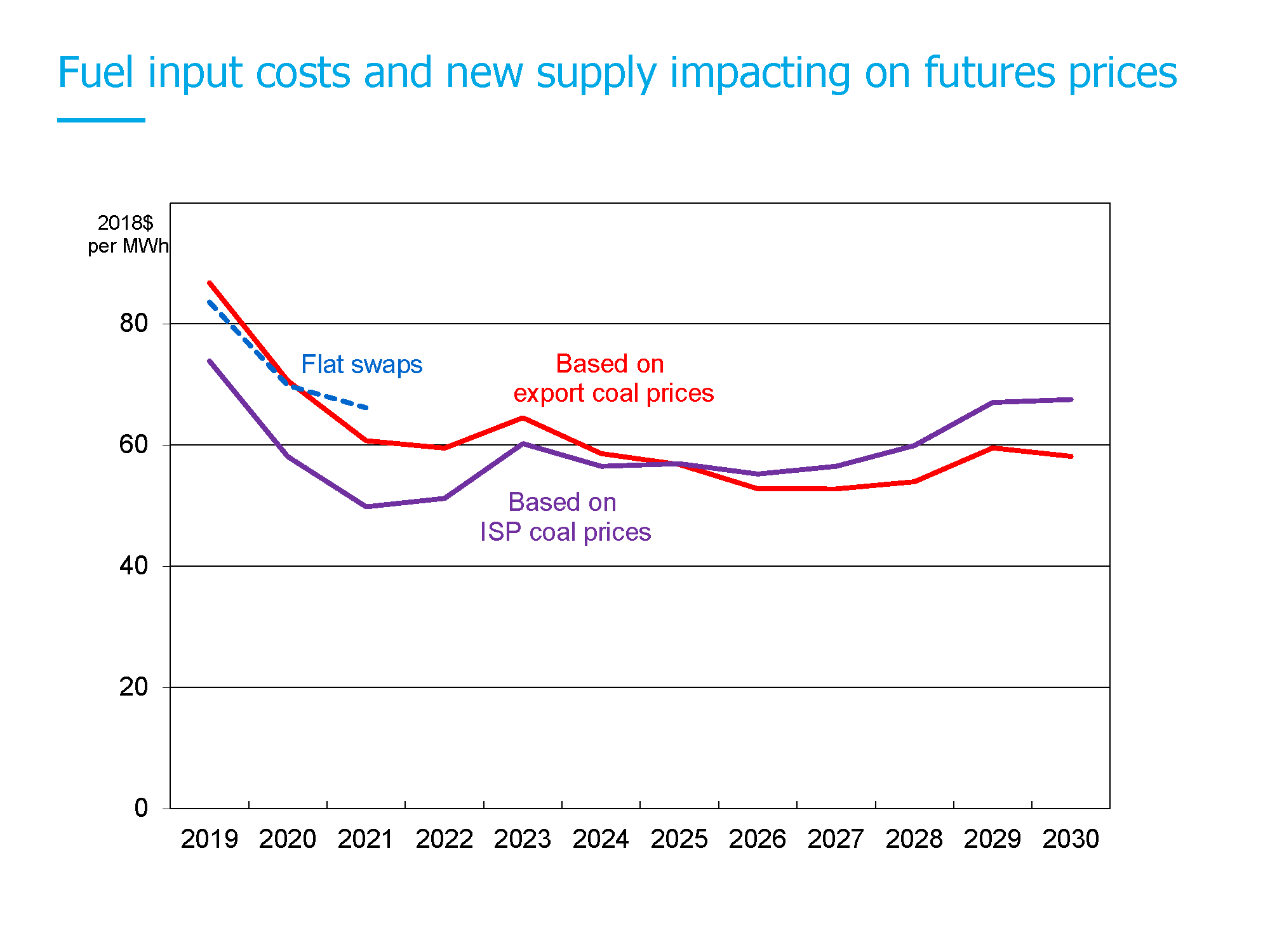

If we look at what's happening in the wholesale market, there are two main factors which, in my mind, tend to drive futures prices.

First we're seeing more supply. It's no secret there's around 8,000 megawatts of new supply coming into the market. But at the same time we're seeing increasingly a lot of generators that are export price exposed in terms of their coal and gas fuel supply. So those two factors are really what's resulting in a lot of the discussion around what might be driving prices in the wholesale market.

This chart shows how fuel input costs and new supply are impacting futures prices.

It shows two modelling exercises. One where we looked at what would happen if you had coal price assumptions based upon AEMO’s integrated system plan, and then we just slightly tweak those to show what might happen if you had export-based parity prices. We’re able to track that against what flat swaps were doing at that particular point in time. So the key point of this slide is that it's not just about generation supply/demand balance any more. It's also thinking through the availability and the price of fuel.

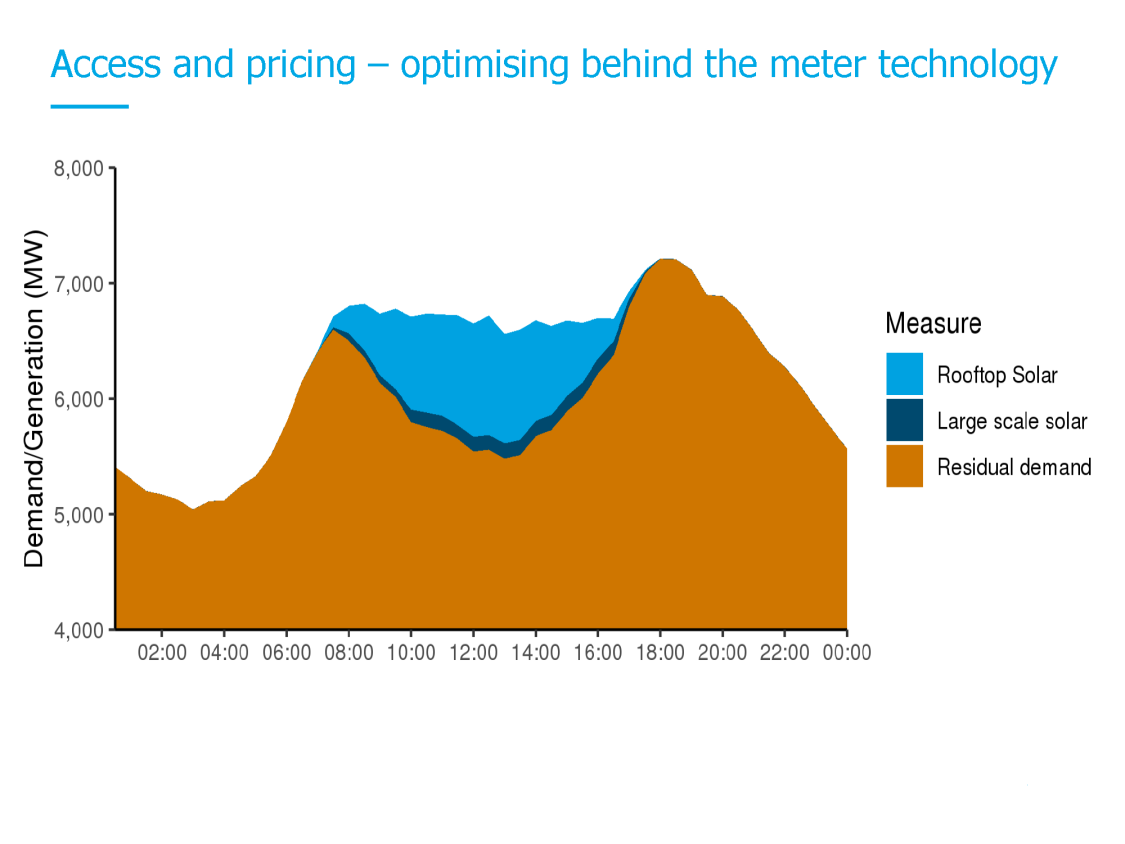

And then the final issue which is the fundamental change over the last 10 years which brings us up to now – is the two million little generators operating throughout the distribution system. This development is fundamentally changing the way in which people think about pricing access and pricing capacity.

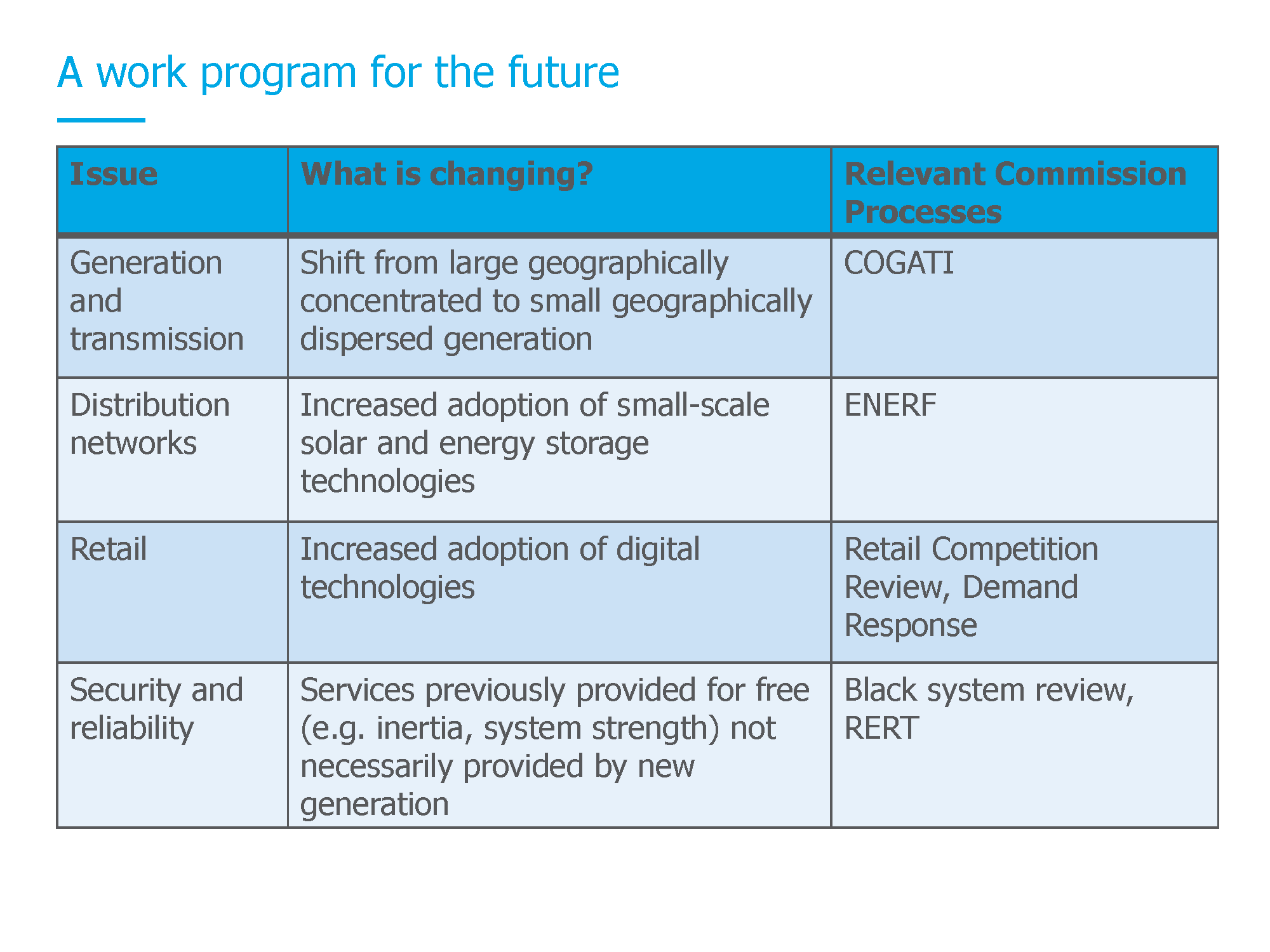

So if I had to leave you with a framework for at least thinking about how all of this ties together, I think it's important that we elevate up a level and focus on what are the fundamental things that have changed; what is changing today; and where might the Australian Energy Market Commission resolve [in collaboration with governments, industry and consumer groups] some of the priority issues creating structural change in the power system.

So I have characterised four issues, generation and transmission, distribution networks, retail and security and reliability; and in the middle column I've said what's changing?

In generation and transmission we've seen a shift from very large geographically concentrated around fuel sources, generation types, to much more geographically dispersed and smaller types of generation. As somebody at Energy Consumers Australia very cleverly put it, we've moved from a small number of large things to a large number of small things.

The Commission is actively thinking about what this means for transmission and for access for pricing through the COGATI process. Just what you all needed, another acronym. COGATI is the AEMC’s coordination of generation and transmission investment review which is working on a transition plan for the power system – making sure there’s enough generation and transmission investment in the right place at the right time to meet consumer needs at least cost.

Distribution networks are also in the middle of an historic transformation as we've got an awful lot of distributed energy resources behind the meter now. We're going to have to start thinking through about how access looks in this changing world; how distribution networks manage that. Again the commission has its economic regulatory frameworks review, which is looking at that issue as we move forward.

On retail, we've got increased penetration of digital technology and we're seeing lots of discussion from stakeholders in relation to the AEMC’s retail competition review, and also through the lens of demand response and being able to deploy greater levels of demand response in a world where more and more people are digitally enabled.

The final point is security and reliability.

Effectively what we've seen is, services that were once provided by generators, largely for free, are likely to require some degree of valuation into the future, and the commission is looking at that through those processes there on the right, its black system review and its work on the reliability and emergency reserve trader.

So I hope that provides a bit of a summary of the issues that perhaps policy-makers didn't foresee coming as quickly as they might have and then a particular framework for thinking about the future. Thank you.

(Short adjournment)

PANEL Q&A

Tim Nelson joined by

Chief Executive Australian Energy Council, Sarah McNamara

Chief Executive Clean Energy Council, Kane Thornton

CEO Energy Networks Australia, Andrew Dillon

MR RICHARDS: All right, I'll ask all our speakers to come back up. Thank you. We actually have almost 20 minutes for Q&A.

So I'll ask the first question of all four of you who, you've all been involved in the market for a very long time. Energy only versus capacity market - are we moving towards more of a hybrid model?

MR NELSON: Given that I'm working with the ESB’s Clare Savage on the 2025 project, I'll be circumspect about how I answer this. But if you unpack it, ultimately a regulated capacity market versus an energy only market really is seeking to allocate costs, risks and benefits in a very different way. So if it's a capacity market, then risks of over-investment are effectively borne by consumers. The national electricity market was a deliberate attempt to achieve allocative efficiency benefits following over investment by prior state-owned electricity commissions.

Now, that said, we already have an existing capacity market through the need to be contracted under the proposed retailer reliability obligation (RRO), assuming that the COAG Energy Council puts the retailer reliability obligation in place as it has foreshadowed.

In my mind, the question really becomes a more complicated unpacking of the issues of what do investors need to put capital on the ground; what is a reasonable risk; reward; and return matrix for those investors - and what are the characteristics of the infrastructure that will be in place. If there's largely heavy fixed cost infrastructure, then that tends to be financed by infrastructure-style investors.

Now, that said, the spot market is really an efficient dispatch engine, it's not an engine that finances new investment. So if we unpack all of those issues, I think it's a little more complicated than just saying it’s a straightforward choice between a regulated capacity market or an energy only market. You have to unpack how it impacts on both investors and consumers but also consider where you're allocating those risks, costs and benefits.

MR RICHARDS: So that kind of implies, as Alan Finkel said to us once, that the NEM is very good at dispatching energy, it's not very good at dispatching capital.

MR NELSON: Well, I think the open question comes to Sarah McNamara's point. If we had have had integrated climate and energy policy from day one, would we be having the discussions now we're having around market design. That’s an open question.

MR RICHARDS: Any other comments around the…

MR DILLON: Yes, the one thing I'll say is we're not just looking at energy any more. The problem is you had an energy only market set up when people making the energy were almost exclusively large synchronous generators, and now you're moving to a market where almost no-one's going to be, eventually, almost no one is going to be that. So the things that people took for granted, like system strength and inertia, have to somehow be valued. Now is that through a market? Does that come through a capacity market? Does it come through obligations on transmission networks? That's a big discussion we need to have.

MR THORNTON: Yes, not much to add between those two to be honest. I mean, I think it's, again it's much easier to reflect on the challenges and limitations of the current market than suggest that moving wholesale to a capacity market's going to fix all problems. I mean, I think we've seen good progress I think in starting to better understand those ancillary services in particular, and I think there's a lot of -there's more work to be done.

If you look at fast frequency response, for example, we know that that's a valuable system service that's not fully valued. There are new technologies out there, and indeed developments that can provide that service into the market. I think the work to be done is how to bring some maturity, better definitions, maturity to those markets. So that ultimately investors, and whether that's about householders, we're seeing this at the moment with householders putting in rooftop solar with particular household inverter technology or battery technology and the way in which that actually gets remunerated, if you like, for the services that they are now able to provide into the system. Fair to say that's not occurring at the moment.

MR RICHARDS: Sarah?

MS McNAMARA: Look, we agree with Tim Nelson’s comments. I think we saw the RRO as being a small step towards a capacity market and we think it is very likely that in the future there will be some sort of centralised reward for capacity. Although having said that, there probably is an ongoing need for an energy only market to dispatch into the market as needs be from hour to hour.

MR RICHARDS: Questions from the floor.

MR PETHICK: David Pethick from AGL. I'll tell a very quick story first and then ask my question. I sat in a meeting about a decade ago and solar systems had hit about 100,000. I think some idiot, perhaps myself, said it's going to plateau shortly. The reason for that story is, I think there are always shocks to the system that lead to reactions. I'm interested in the panel's view as to what shocks you think might be coming our way.

MR THORNTON: I'll have a go. I was sort of in the solar industry when it was at 100,000 and I won't say I told everyone it was going to happen, it was coming - but sitting here now, it feels a bit similar in terms of battery technology. We've all seen costs shifts and Bloomberg has got a really interesting chart that talks about trends of technology deployment. It suggests that the pace of uptake of battery technology has all the characteristics to be even faster than rooftop solar. There’s a bunch of reasons why it will be slower and more complex, but my sense is it’s going to come quicker than people have anticipated. And if you look at the success of the Hornsdale battery project, I think batteries at all scales are going to come very fast, and the level of disruption and change that comes with that I think is even greater than what we've seen from rooftop solar.

MR DILLON: Tim, are the rules ready for that?

MR NELSON: Look the current market has seen huge amounts of investment to date so I think it's an open question about at what point you get to a level of different types of technology penetration that require rethinking of things like ancillary services remuneration. If I reflect on David's question around what might come out of left field, I think left field of the industry is the increased focus on the consumer data right. And also how consumers will be in a much better driving seat of their own futures once they have digitalisation of their energy consumption - because that really does shift the game in the sense of demand response.

The economist in me says, in the very, very long term, you can see a pure, two-sided market. If you go right back to 1988 when Fred Schweppe wrote the book that basically led most of the developed world down the pathway of micro-economic reform of electricity markets, that was the end goal, the two-sided market. The digitalisation of consumer data becomes a really important left field part of the story.

UNIDENTIFIED SPEAKER: To Sarah and Andrew, then, are retailers, generators and the networks really tooled up for that two sided market or is there still resistance to that as in more demand response from consumers and more consumer engagement?

MR DILLON: Certainly from the network end we have to enable that, and we've seen publicly in the last few weeks a somewhat insane debate about electric vehicles, and I think it's a classic example, though, because no one sitting here in the room knows how many electric vehicles there will be on the roads by 2030. We may get to the stage where Labor's 50 per cent of sales target is seen as either ridiculously ambitious in five years' time, or it's going to be passed well before that. So from our end, it's how do we best be ready for a variety of scenarios making sure we have scenario planning in everything that we do in terms of capital but also scenarios informing policy development.

MR RICHARDS: Sarah.

MS McNAMARA: I think there's no reason why retailers won't be ready to talk to their consumers and respond well when these sort of transformational changes are occurring. One of the key impediments to that is government policy. What springs to mind immediately is the re-regulation of the standing offer prices through the default market offer federally and here in Victoria through their default offer locally. Those things do impede flexibility in the market. They impede retailers' ability to innovate and deliver the customer the kind of solutions that they will need in that future.

MR RICHARDS: Other questions?

UNIDENTIFIED SPEAKER: Hydrogen raises the question of just how integrated should our thinking on climate policy be. We've had a lot of discussion about the electricity sector, not just today, for the last couple of years. But if hydrogen takes off, like globally, the Australian electricity system might grow by multiples, by ten times its current size. How do we have a meaningful discussion about market reform when the breadth of possibilities is as wide as that?

MR NELSON: Well, that's a hard question to answer. So one of the first things I would say is, we can't just look at electricity or just look at gas. I mean, it's been clear, we've been involved obviously, and others in the room would have been, in the development of the National Hydrogen Strategy which is ongoing at the moment, and some of those discussions have brought that point out very clearly. It can't just be about our gas system, it can't just be about electricity. It can't just be about transport, it can't just be about industry. It has to be some combination of all of them, but how do you do that without getting lost in this high level debate where your variations are so high?

So I don't really have the answer for you. But it’s a balance of looking broadly across a variety of scenarios and trying to ensure policy in the electricity space is geared to that. But taking just electricity, one thing I would say is, we haven't been good at doing that. We have tended to look at generation in a bucket, networks in a bucket and retail in a bucket, and consumers pay total system costs. We do have to have integrated policy.

MR THORNTON: I think hydrogen is an example of one of those massive game changers and I think in this case the demand is likely to already be there for the Australian marketplace in the form particularly of Japan and also Korea and the targets that they've set. I think the pace at which the opportunity could take off is pretty extraordinary, and indeed again could be another example of Australia having to play catch-up to market drivers that are far outside of the reach of Australian policy-makers or regulators.

MR RICHARDS: Anyone else want to take a swing at hydrogen?

MR DILLON: I just reinforce that really what opportunities like hydrogen present is really a reason for ensuring that we keep focussed on markets is the best way of allocating capital - because we want to see a situation where benefits of these opportunities are extracted by deploying capital in the most efficient way. In my mind, that's where some of these debates around locational pricing signals start to become really important. If that future plays out in the way that you've suggested that could happen, then we're in a world where there is great opportunity, but managing that efficiently does require the use of you know, pretty detailed pricing signals.

UNIDENTIFIED SPEAKER: Andrew, you mentioned three key words there for me, the total system cost. It's something that's been a bit of a hobby horse for ours and will continue to be. We clearly saw from Kane's slides that LCO renewables is cheap and it's only going to get cheaper. We kind of know what battery costs curves are doing and we kind of know what it's going to cost to build out the grid. But no one's really putting that together. I mean, you've got the ISP and COGATI. They're not quite getting that total system cost program. What are the steps that we need to take to understand what that total system cost of the transition is going to be, and can we please put that into the 2025 program, because unless we know that, then you know, we're going to be still at base one, so any suggestions. Can we move the ISP into that area? More questions.

MR DILLON: Well, can I give you the pure economist way of looking at it. The total cost is likely to be the same if you assume that you deploy the same types of technologies, whether it be renewables, batteries, transmission, whatever it might be. Where it becomes important in my mind is to think through who should wear the risk of investment and who should benefit if they invest appropriately. And that's where I think we are a bit - we are at a bit of a fork in the road where there is a temptation to always say, "Well, if we just build lots and lots of stuff, the world will be a better place", but we've seen that play out before and I'd refer people back to the 1980s. Some of the data points that I had in that particular slide, and I think therefore we do have to be very thoughtful about the way in which we think through, can we use market-based signals to incentivise the right investment in the right locations to capture these technological opportunities.

SAM: Sam from Alinta. I've just got a question probably for Kane. We've heard a lot today about some of the challenges for renewable developments and marginal loss factors (MLFs). Obviously there's cost and risks that are coming through so if they can't be resolved in the short-term, is there a chance we'd sort of see potentially a bit of a bottoming out of the sort of renewable prices which often are expressed as PPA offtakes for the people in the room.

So you know, we may be seeing a bit of a flaw there that may have to come up as developers start to cover a bit more of those risks if they can't be resolved quickly because you mentioned, you know, one of the options is that developers just pack off to another country, or the other option is, well, maybe some of the off-peak prices may have to come back up to reflect those risks. Any thoughts on that?

MR DILLON: It's too early to call, the market's kind of peaked. It looks like it probably has and there's a bit of a slowdown starting to occur, and in some, to a certain degree that's because the renewable energy target has been delivered. There's no further high level policy, there's no national energy guarantee, 2020 looming, so some of it's about that. But it is much more significantly about both the grid connection challenges and the marginal loss factors uncertainty.

And you know, I guess you can speculate as to the extent to which that means development stops, and if you just remove the broader policy market pricing question and just focus on grid connection and MLFs, I think from a grid connection perspective, the implications are, it takes longer, and it's more expensive, and so those two factors alone don't mean that investment will stop. I think MLFs, to be honest, are the biggest risk - the bigger risk, and that's largely because it's a near unmanageable risk.

A developer has an opportunity to respond to essentially, if you like, what's a locational price signal. They have an opportunity to respond to it at a point of decision. Once they've made that decision that it's essentially unmanageable, and given the level of variation we've seen, MLF shifts of up to 17 per cent last year, 24, round 24 per cent this year, that's a massive risk that people just can't manage.

And so essentially I think no amount of higher project costs can, I think, offset what is essentially an unmanageable risk, so I hope that - I guess that's, from our perspective, why we're looking for change and reform, both to the grid connection process, and I'm optimistic about that. We're getting progress, I think network businesses are actively engaged, so AEMO, there's a lot of dialogue about how to refine the process provide greater transparency through that process, but MLFs I must say are the one that keep me awake at night to a greater degree.

And I think the pace of reform and change on that one, I think, is, to be frank it's too slow, and if we're sitting here this time next year with MLFs swinging again, which there's no - in fact, there's a lot of reasons why they will under the current methodology again this time next year, then we're in a world of pain, to be frank, and investors will - they'll go to markets where they can manage that risk.

MR THORNTON: Yes, if I can add to that, I think one of the challenges we have, if you step right back, we basically had an open access regime, and whether you're talking about a transmission level where it's clearly manifesting big time, or even seeing a part of the (indistinct) with solar at the distribution level is the same thing, is that - and policy-makers and governments in particular like to think that we can just plug into the grid and it's a sponge and it'll be find, and clearly technically that's not true, and once you hit certain levels of whatever it is, we're starting to see these problems manifest.

The challenge is, they're manifesting very rapidly both at distribution and transmission level, and we need to figure out what are the proper policy responses, who should pay what, how do we send pricing signals. I mean, I'm not an MLF expert, but one of the problems is, if you move to a more dynamic approach, it's possible some renewable generators that are hurting at the moment will hurt more because if they get charged in the middle of the day it'll look even worse, and there's no doubt there should be some signal for load is here, generation is here, there are losses. So the fundamentals don't change. It is how we do it and therefore what signals are we giving to investors.

MR RICHARDS: He'll be at the bar. So that brings day one to a close. Thank you