Australian Chamber of Commerce and Industry

Chairman John Pierce AO

Australian Energy Market Commission

The Australian Chamber of Commerce and Industry has invited our chairman to address members at a series of energy forums around the country. John will speak to members in Melbourne on 6 June and Brisbane on 18 July.

Here is his Sydney address delivered on 11 April 2019 (edited)

***

MR PIERCE: Thank you James and Stephen and to the chamber for organising this forum, it’s a great opportunity for me to listen and to hear from you in regard to the issues that you're confronting in the sector at the moment and I’m very much looking forward to that interaction later. First I'll say a few things to perhaps frame some of the discussion.

There are two things I wish to touch on. One is to say a few things about prices of course and what's caused them to go where they have, in very broad terms, and then second just a few words about the Commission, who we are, and what we do.

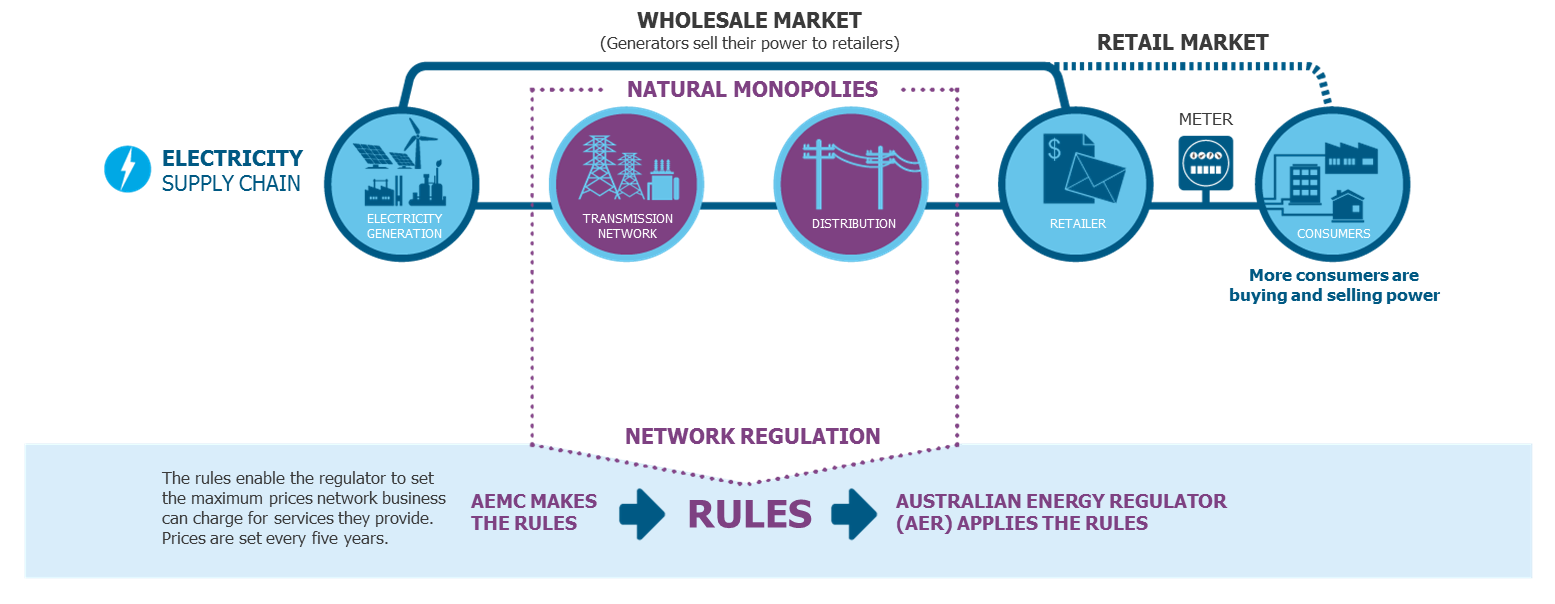

In terms of background and context prices are really derive from two main parts of the supply chain, one part being the competitive generation and retail components, and the other regulated monopoly network sector.

Now how much of your bills is accounted for by each of these two parts can vary widely, depending upon what sort of customer you are, where you are located and how much of this stuff you can consume. But in very broad terms in New South Wales the average is for the network sector to account for about 47% of people's bills and the competitive sector including the impact of environmental policies makes up the rest. That gives you a sense of the weight and the relative importance of these sectors.

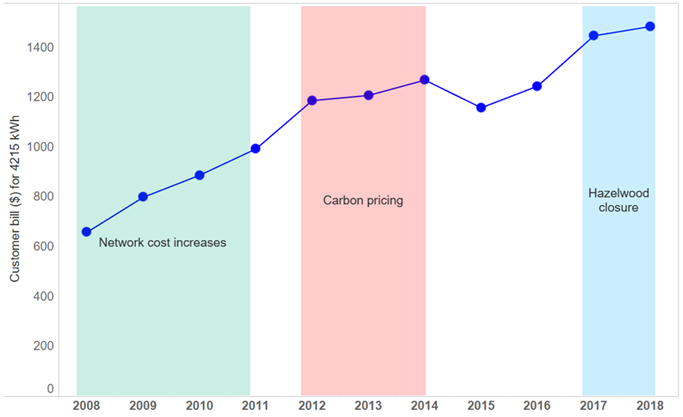

So what's happened? The Commission has published a time series of price trends data for the best part of a decade. In that work we have focused on the major drivers of electricity prices – what’s driving them up and down over time. The price trends annual report is not so much about specific numbers but to produce a clear picture of how policy and market decisions affect consumer prices. It provides the transparency that governments need to understand whether price changes proposed by retailers are consistent with changes in underlying costs. It provides context for government policymakers to understand how decisions being considered now are likely to affect prices in the future.

This next chart highlights the pattern of what's been driving prices.

In the earlier period the major driver of the price increases were decisions to boost distribution network reliability which saw investment costs rise in that regulated network sector.

We had a blip, for want of a better term, during the period when the carbon price was in. Then followed a few years of slightly falling – what I would call essentially stable prices, until we started to get large chunks of capacity being withdrawn from the market with a series of power station closures including Hazelwood.

So in recent times, the major driver of changes in electricity prices has been the generation sector and if you want to do something about these price increases we think it's rather important to be able to diagnose where pressures are coming from so that solutions can be targeted to the right part of the supply chain.

So what's happening now? The Commission's been talking about this for a while now. To state the obvious, the biggest energy sector restructure in Australian history is underway. This change means there are opportunities and challenges at both ends of the supply chain – wholesale generation and also retail.

The data we produce and analyse shows a long, slow, steady improvement in retail competition - and remember this is very recent for energy – electricity retail deregulation is a lot, lot younger than mobile phone market competition. So retail competition is stronger and starting to deliver benefits to consumers – with new deals and services, and opportunities to switch and save - but wholesale costs are driving up retail prices and putting those emerging benefits at risk.

Certainly for us right now, there's a focus on the wholesale sector and the effect that the changing generation mix has on security, reliability and price. Wholesale generation is in transition to a cleaner, greener system but the scale and speed of renewables connections is causing stability problems that have to be fixed.

And above all the changes in the technical characteristics of the generation happening has to be managed to keep the costs of transition as low as possible for all consumers.

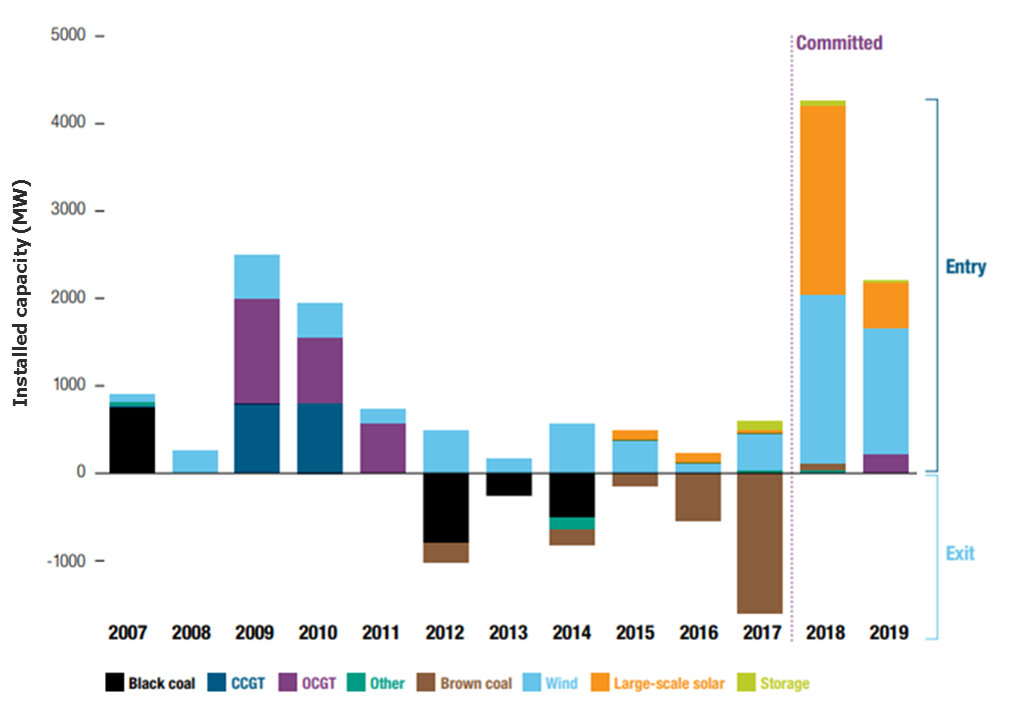

Changes in technology and those impacts on the economics of the generation sector does pose different issues than faced in the past but with the right agreement among governments, industry, consumer representatives and market institutions quite solvable - a bit more on that later on. This chart is an indication of the nature of these very significant changes that are underway - with big chunks of coal power stations exiting from the market.

And in contrast is the very significant increases in capacity with megawatts coming from technologies with different technical and operating characteristics.

The other thing about this sector of course is that every bit of it is connected to every other part - like a machine where every component has to work in harmony with every other component for the machine to work. The totality of those effects is what drives the resultant total industry costs and consumer prices.

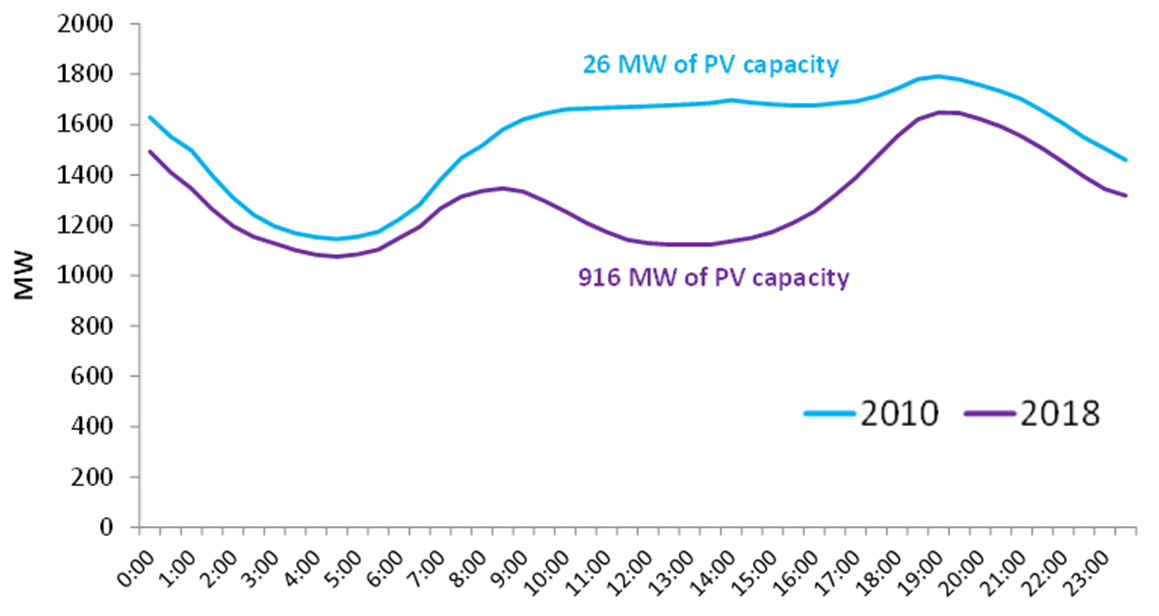

A consequence of this change in technology is a changing pattern of demand that the centralised or large-scale power system has to meet. The chart below is an example of this change over time – you can get similar examples form different parts of the country at different times of the year. They all generally tell the same sort of story.

The amount of load that needs to be met during the middle of the day by the large-scale power system is diminishing. In some parts of the sector, especially at the very heart of distribution networks, there are now particular times of day where demand is negative because of the amount of generation that’s being fed into the network from solar PV. This is manifested by the fall-off of load in the middle of the day. The result is a new operating environment for large-scale generators which cannot just run consistently during the day. Now generators are being asked to turn on and off. Consequently generators will face increasing costs to stay in the market.

Now the Commission is not theological about technology at all.

I'm obliged not to be in statutory terms, but I am statutorily obliged to care about reliability, security and price for consumers. So who is the Australian Energy Market Commission? We are rather unusual. The Commission is a creature of the Council of Australian Governments (COAG). We basically do two things. We have a statutory role in making rules that govern the gas and electricity markets. We also provide advice to the council’s energy ministers about broader market development and policy outcomes.

Our rulemaking role is quite unique. The institution was set up and given this role as a by-product of the nature of our federation. The end result is a system of open access rule making. Anyone, any company, government, advocacy group or individual person, can propose a change to the rules. Anyone, except the AEMC itself. We are very careful about how we express ourselves during the rulemaking process. We want anybody who proposes a change in the rules to be confident that their proposal is going to be evaluated on its merits against the statutory obligations that we have around the long-term interests of consumers and the national energy objectives which are enshrined in law.. In that sense, how the market develops, and how the regulatory arrangements and rules develop is I think in your hands as much as it is in the hands of governments. I think that's an important characteristic of this sector. We of course in the process of making the rules, affect the outcomes of consumer experience but over and above the rules are outcomes which you experience as a result of the things that governments do in and of their own right.

The thing that keeps me awake right now and most immediately are the technical security issues facing the power system.

In energy world speak there is a significant difference between the meaning of reliability and security. Reliability is about whether at any particular point in time there are enough megawatts on the ground and operating to keep the lights on. The security issue is all about whether the power system is being operated so that it stays within its technical operating parameters even in the face of shocks that can hit the system at any time on any day.

You may have heard discussions around things like voltage and frequency. These can be, and are, impacted by things like lightning strikes, bushfires and equipment failures on the demand and supply sides. Those technical things, how they are managed, has changed a lot, and will continue to change a lot because of changing technology in the generation mix.

When you are a customer and the lights go off – that difference will probably be lost on you. But it’s important for everyone who is responsible for the power system.

Security events tend to be things that you cannot control. The classic example was when South Australia blacked out. Maintaining a system that is secure and safe means understanding the technical characteristics of all the components that make up the power system and how they will behave when shocks to the system happen. That's the most immediate issue, and most immediate priority for us – making sure that security is delivered at the lowest cost possible for consumers.

So in conclusion – we have already discussed the ability of individuals and organisations to submit rule change requests. That does not need to be a very complicated process. We offer a service that's been taken up by NGO groups and consumer groups, where people with concerns about the system or ideas on how to fix a problem can come to sit down with our staff. We can't tell you whether your proposal is going to be successful or not in the beginning before we consider all the evidence and give stakeholders the chance to provide feedback. But we can guide you through how the proposal may be structured so it can meet the criteria for formal submission. We'd certainly welcome anybody who has ideas on how best to respond to the sector’s continuing evolution. Thank you.