Anna Collyer, Chair

Keynote address, Australian Energy Week Conference 2025

Melbourne Convention and Exhibition Centre

Like others before me today, I acknowledge the traditional custodians of the lands, waters and skies where we live and work. As we strive for a cleaner energy future to mitigate the effects of climate change on our lives, the AEMC recognises that First Nations people have cared for all these places we now call home for millennia before this time.

I pay my respects to the enduring relationship that Aboriginal and Torres Strait Islander peoples have to Country - and to the lessons that relationship has for all of us.

The future – working with the known unknowns

But today, I want to turn first to a different country. Recently, I was invited to San Francisco to meet with energy regulators from around the world and discuss how we are each managing the global transition to net zero emissions.

We had some fantastic deep conversations about the challenges we are all facing. And while there was plenty of common ground, it brought home to me yet again how far advanced we are here in Australia from an energy markets perspective.

The nature of our grid and resources has forced this vanguard role upon us.

The sheer size of our connected grid, the collegial history of our NEM jurisdictions, and the Australian consumer’s love affair with rooftop generation are just a few of the things that set us apart and demand we come up with entirely original solutions, and I will speak more to this later.

But while I gained many professional insights, the personal highlight of my trip had to be the rollercoaster-style thrill of getting into a driverless car for the first time.

It’s a very strange experience (as you can see from my face here) but I did manage to get from A to B without having an accident or even a near miss, which is more than I can say about the human driver we had the day before!

That Waymo trip made me think about how the future can creep up on us.

I can remember talking about autonomous vehicles a decade or more ago in my previous life in corporate law. We pondered legal questions like how to regulate AI decision-making, and how the insurance industry would adapt. I’m sure there are engineers in the audience here with even more questions about systems and safety, too.

Talking to Australians when I returned, I was a little surprised by how many said they wouldn’t get into a driverless car, and a lot surprised that two of those risk-averse people were my young adult son and his girlfriend.

Our colleagues at the California Public Utilities Commission were involved in the licensing of Waymo cars and grappled extensively with the many unknown factors they were introducing.

This included initially letting empty Waymos loose on the streets for a trial before allowing passengers.

On balance, though, they and the other relevant regulators had enough confidence in the overall benefits to customers to give it a go – and, setting aside the recent LA turmoil, it has proved to be a very worthwhile risk.

It seemed like a good analogy for where we are today in the energy transition. The future is certainly creeping up on us and we have no choice but to deal with the known unknowns of the energy transition if we are going achieve better customer outcomes.

Eventually, just like steam trains and aeroplanes and rocket ships, someone has to agree to be the first person to ride in a driverless car.

Now, I don’t have a crystal ball – none of us does. But we also cannot wait for the comfort of complete certainty before we act. We need to accept a level of uncertainty, and get on with it.

Three topics today

The three areas of the transition I want to cover today are all great examples of our known unknowns.

First, managing gas. If you were a fashionista, as I aspire to be, you would say that the gas transition is the new black. If we grasp the challenge, and I believe we will, we have an opportunity right now to achieve a more orderly and effective exit for gas than we have done for coal. The difference is how gas may prove to be a necessary enabler for a fully renewable system.

Second, it wouldn’t be an Oz energy week if I didn’t discuss the impact of CER on our future energy system and how the consumer is the hero on the road to net zero. Today, I want to discuss our pricing review and the opportunities we see for all customers if we treat energy as a service, not just a product.

Finally, we heard from Tim Nelson this morning about the independent panel’s review of wholesale market settings. As a deeply engaged stakeholder in that important work, I’d like to offer some observations as well.

Strategic narrative as a tool

Everything I say today is in the context of the AEMC’s vision for the Australian community of 2050, and the Strategic Narrative report we’ve developed to help get us there.

Initially, this was an internal document. But we made it public because it became useful for understanding common challenges, such as prioritising multiple, and sometimes contradictory, issues simultaneously.

This is also why we framed it as a narrative, which is separate to our more conventional strategic plan. The narrative approach freed us to consider potentially conflicting short and mid-term outcomes against the long-term gains that we all need to achieve.

We hadn't done something like this before at the AEMC and it took us out of our comfort zone – but we did need new tools to help us make decisions despite the uncertainty of these times.

We certainly didn’t reinvent the wheel, but we absorbed the learned works of others to articulate our shared vision. As our north star, we’re using the narrative to guide the prioritisation of our work, how we solve problems, and the inevitable trade-offs that need to be made along the way.

We identified the eight interrelated challenges and opportunities we think will be enduring themes as we work toward a consumer-focused net zero energy system.

I won't go through all of these now. The full narrative is on our website and I encourage you to take a look if you’d like to understand more about how we’re using it our work.

Gas

But what you’ll see up there is that the role of gas in the transition presents a challenge of its own.

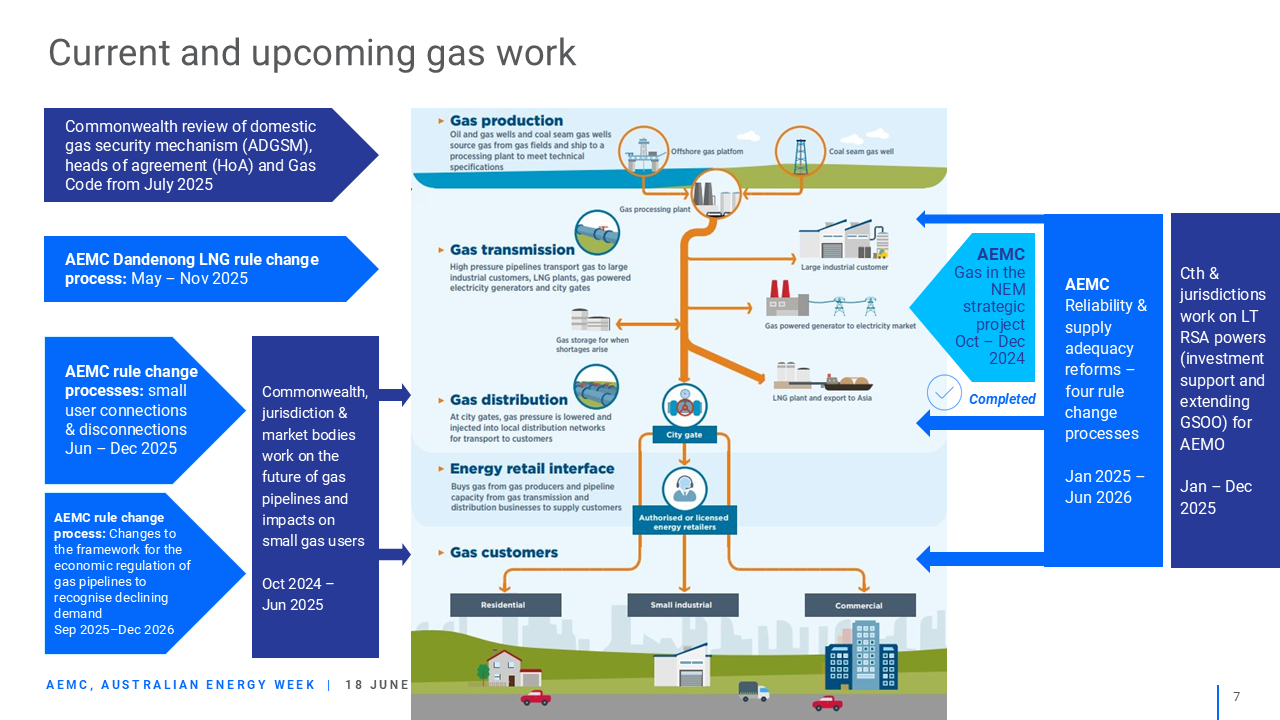

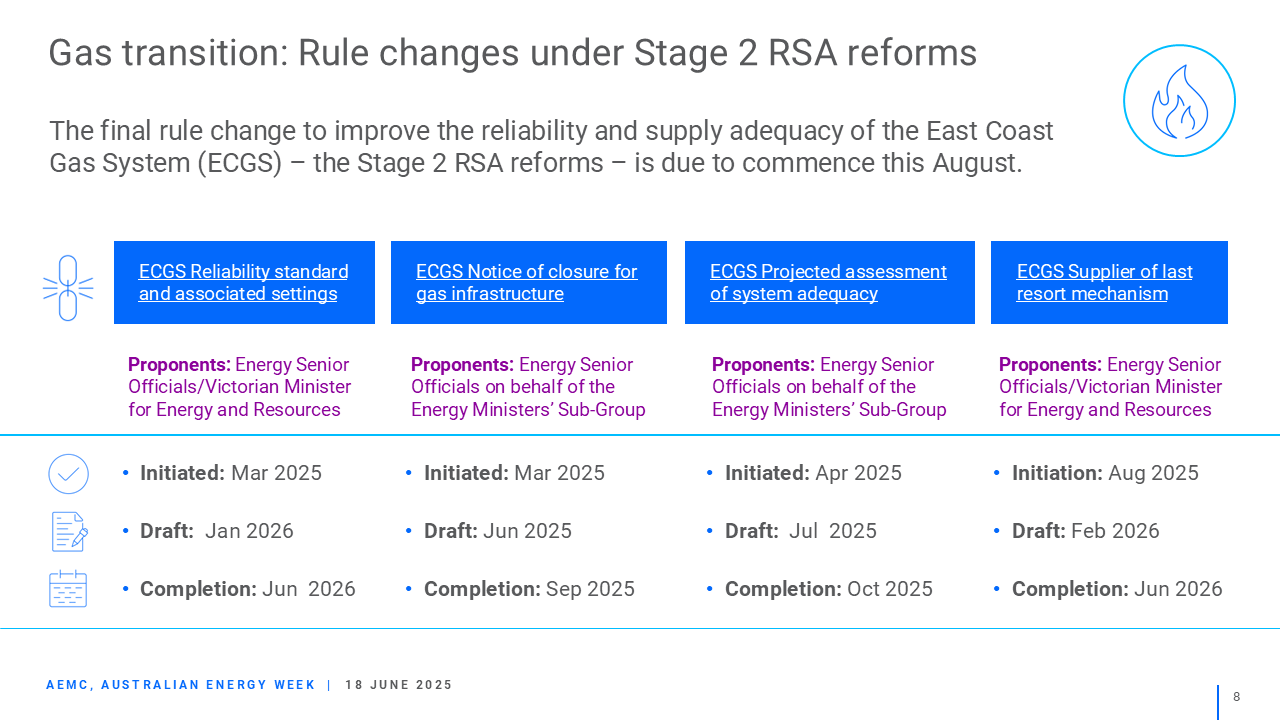

I’m sorry about the busy-ness of this next slide but it’s an indication of the busy-ness of our work in gas now.

In my first few years at the AEMC, gas matters were in the minority of our work program, apart from a pretty significant piece of work on how to incorporate renewable gases into the regulatory framework (which I’ll come back to again shortly).

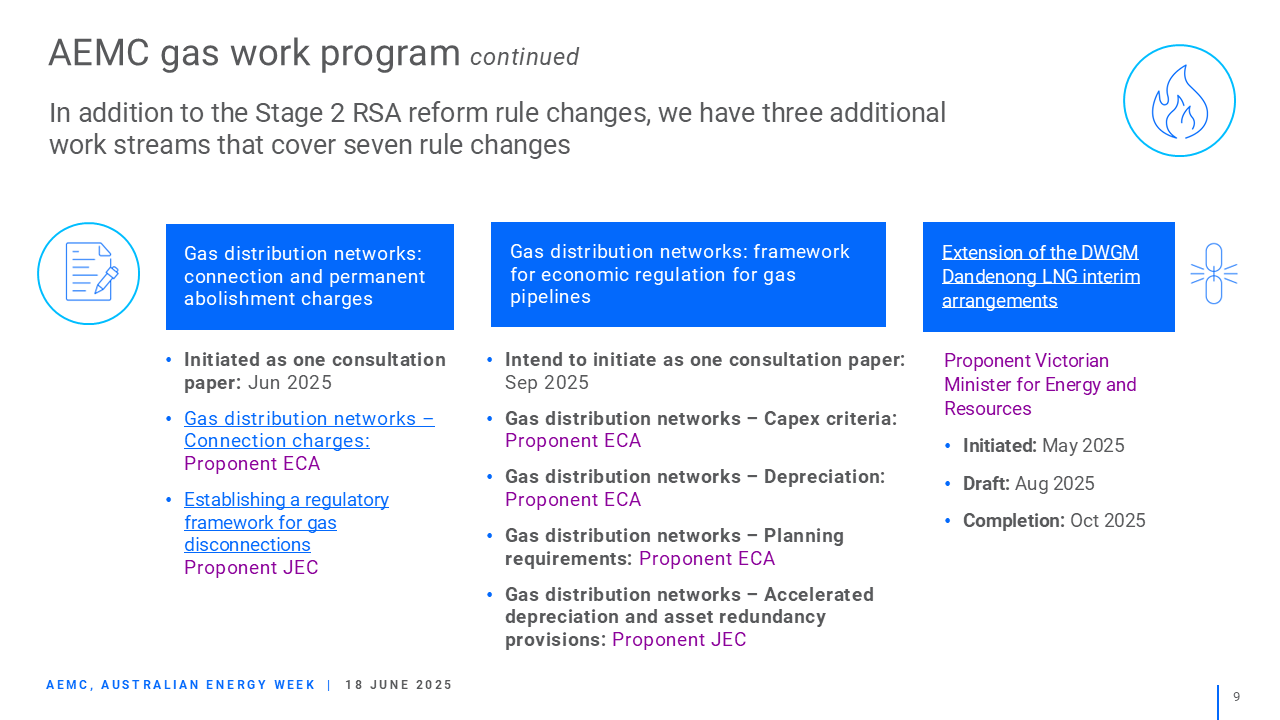

Now? We have a growing and comprehensive program of rule changes addressing challenges of the gas transition.

To repeat my earlier point, we have the chance to effect an orderly transition for gas, in contrast to what we’ve been able to achieve for coal.

Our rule change work neatly captures the challenges of where we are in the gas transition right now.

On the one hand, we have a package of rule changes aimed at addressing concerns that, in the foreseeable future, we may not have enough gas in the right places at the right times to meet all of our peak system needs.

These rule changes were given to us by energy ministers as a complement to new powers extended to AEMO back in 2022.

They asked us to consider whether some of the tools we use in the electricity market to navigate potential shortages in supply can also be helpfully translated into gas markets (which, of course, are a very different beast).

On the other hand, we also have a set of rule change requests from consumer groups who are concerned about what the longer-term trajectory of a decline in gas usage means for the gas distribution network, and who is going to bear the risks and costs associated with that decline.

These requests make the point that the gas regulatory framework was designed not only to accommodate but also to encourage the growth of the gas network, whereas we now expect to see its gradual decline.

In the middle of this is industry, wondering where to focus its investment.

Some of our unknowns include what is going to replace the service gas provides in the electricity sector?

What is the role for renewable gases for electricity generation or other current gas users?

Can we repurpose existing gas infrastructure, and over what time horizon will all of this happen?

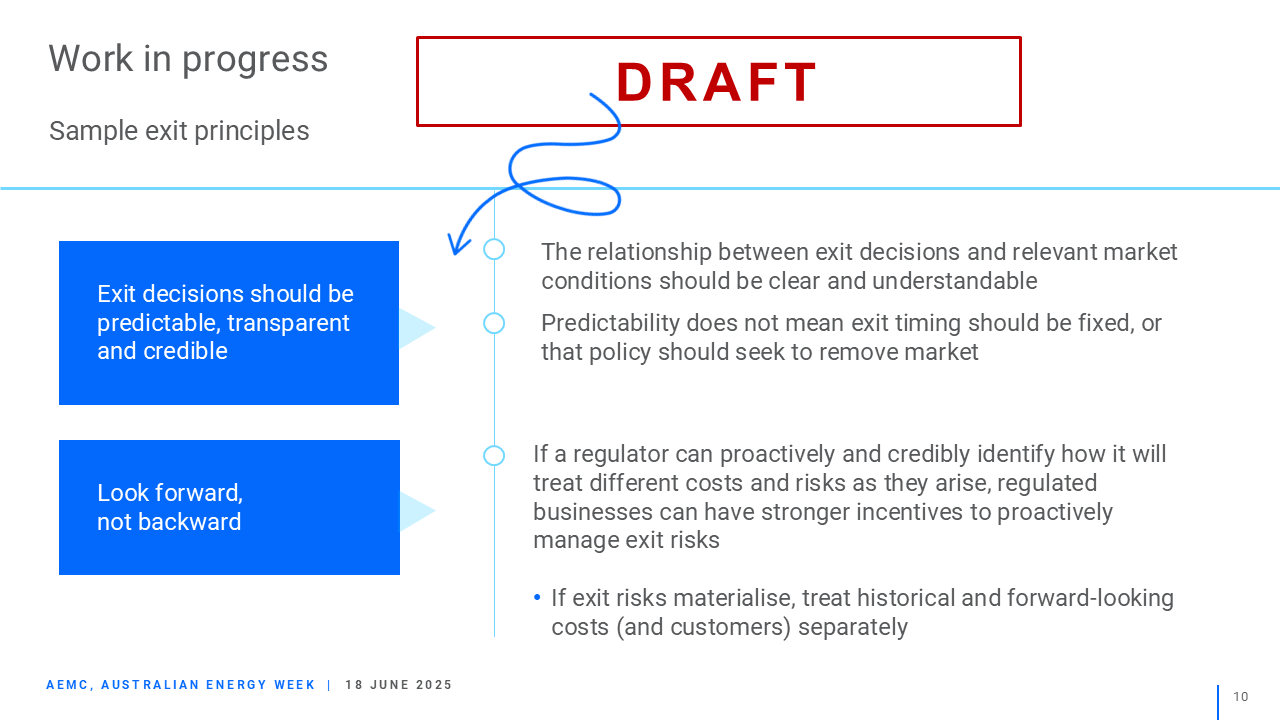

When making decisions in the face of this kind of uncertainty, another tool at our disposal is the use of sound decision-making principles.

In this respect we of course have the national energy objectives, which require us to focus on efficient investment in and operation of energy assets for the long-term benefits of customers. Now, they also take into account emission reduction objectives.

But how do you apply the national objectives to a fuel source in decline?

Well, we know there are examples of where this has already been done, for instance, in the orderly exit management framework and we wanted to draw some guidance from those examples.

We’ve been working on our own set of ‘exit principles’ as a way of guiding some of the more challenging decision-making in the transition away from gas as a widespread fuel source.

I’m sharing two of those principles on the screen now. This is very much a work in progress but I think it’s worth you all knowing that it is underway.

Transparency is obviously crucial when it comes to exiting a fuel source from the market. While I’ve been talking about all the unknowns we face, it is always possible to find areas of reasonable, credible, and predictability. Where we can see that direction, we have a responsibility to share it with the market.

The other idea for an exit principle I wanted to share is the importance of looking forward.

From our position as rule-makers, some ways we can look forward could be:

to assume that past investments were made in good faith and

to ensure that future investment decisions can incorporate exit risks.

This means proactively identifying exit risk so that fewer costs are sunk and, as a regulator, not simply shifting risks from the business to the consumer or de-risking the business unnecessarily.

Alongside work like this, of course, we have major efforts like the Commonwealth’s work on reviewing gas supply and transition nationally. This will be an excellent opportunity to fill in some missing predictability, and, therefore, transparency and investment confidence, as we all move ahead.

It will also be good news for customers, particularly large consumers in hard to mitigate industries like brickmaking and domestic gas users in heavily dependent states like Victoria.

Pricing review

Which brings me nicely back to the reason we are all here – customers.

It was great to hear Minister Bowen this morning talk about the importance of equity in the energy transition, and to acknowledge the work energy ministers collectively asked us to do to improve customer protections.

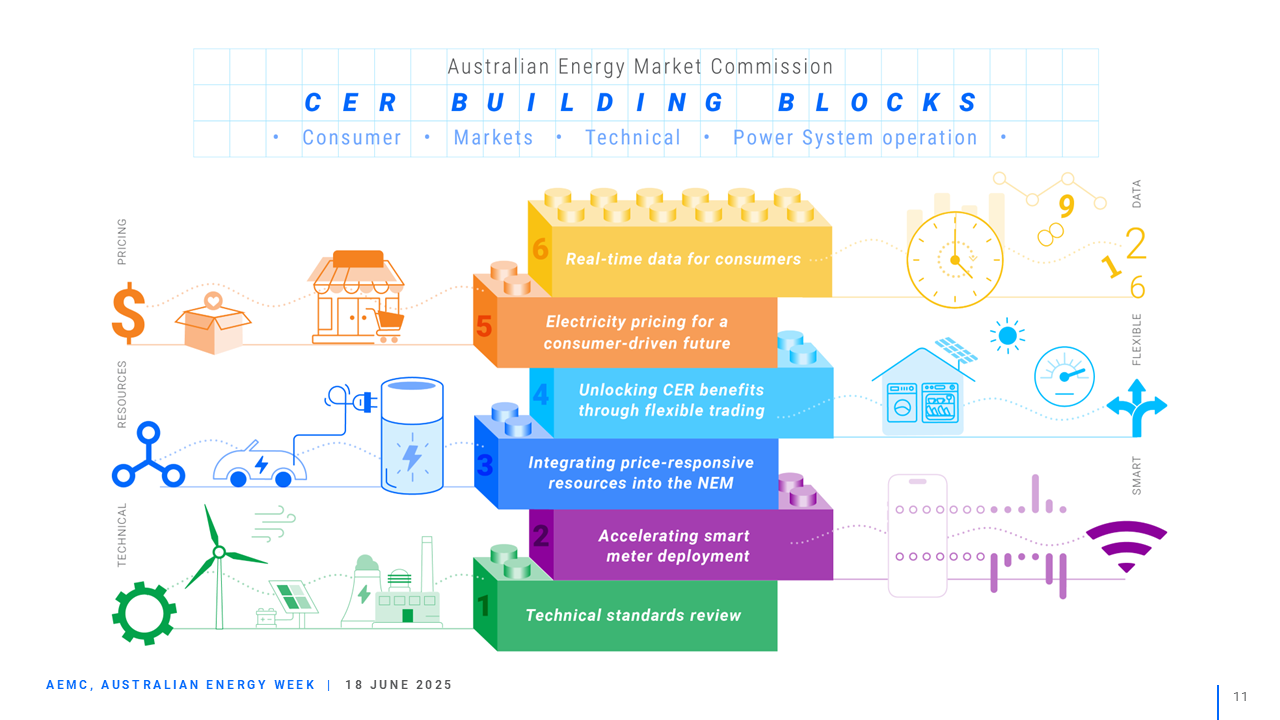

We continue to have a busy work program in this area that responds to many of our narrative themes. This includes the opportunities created by CER and the importance of equitable outcomes and consumer trust for achieving the energy transition.

I want to focus on one particular workstream today, which is our Pricing Review – that’s the orange lego block up on the screen.

We knew when we started this would be hard and it has proven to be so.

What we wanted to do was start with the consumer and start in the future and this has meant a little bit of going slow for now to (hopefully) go faster as we complete the review early next year.

Our discussion paper, published last week, synthesised an enormous amount of stakeholder interest and input into three key areas of focus. We recognise that this is one piece in the great big puzzle of CER Reform, and we can't, and don’t need to, do everything in this one piece of work.

Our questions start with the presumption that in the future we have different consumer archetypes with different access to CER, and with the ability and capacity to choose how they use it.

At this conference last year I shared a story about three kinds of consumers of CER – those who are obsessed, those who are in a mess, and those who couldn’t care less.

Now, the archetypes of the future will be a lot more complex than my version, but it’s certainly true that many people think the customers who just want a simple service for a simple price will always be in the majority.

So whether you’re one of those customers, or someone who is keen to get engaged with technology and be rewarded for doing so – we want to make sure there is something for everyone.

That probable minority of engaged customers – and perhaps they are the same people who will be the first to jump in a Waymo – can deliver savings that benefit everyone if we get those rewards right for doing so.

And I have a fun example of this, which is just around the corner for Australia. AEMC researchers have done some early analysis of what we expect to see from the federal battery rebate, with two interesting outcomes.

Firstly, the federal rebate alone could deliver exactly what we predicted a couple of years ago would be a turning point for affordability.

We forecast that the payback period for domestic batteries would drop to seven and a half years in 2025 if the right incentives came along. Our numbers now show that a typical customer taking up the federal rebate can expect their battery to pay for itself in 7.3 years.

Secondly, the lucky and engaged customer from NSW, for example, who can combine both the Federal rebate and recently revised NSW virtual power plant scheme, can expect the payback to shorten to less than four years if joining a virtual power plant.

And alongside their personal benefit, that customer’s VPP participation is helping the wider community and, importantly, sharing the joy with those people who can’t access any CER advantages of their own.

Which neatly illustrates the two objectives of our pricing review:

to deliver the range of services that different types of customers will want, and at the same time

to keep the system's cost down to benefit all consumers.

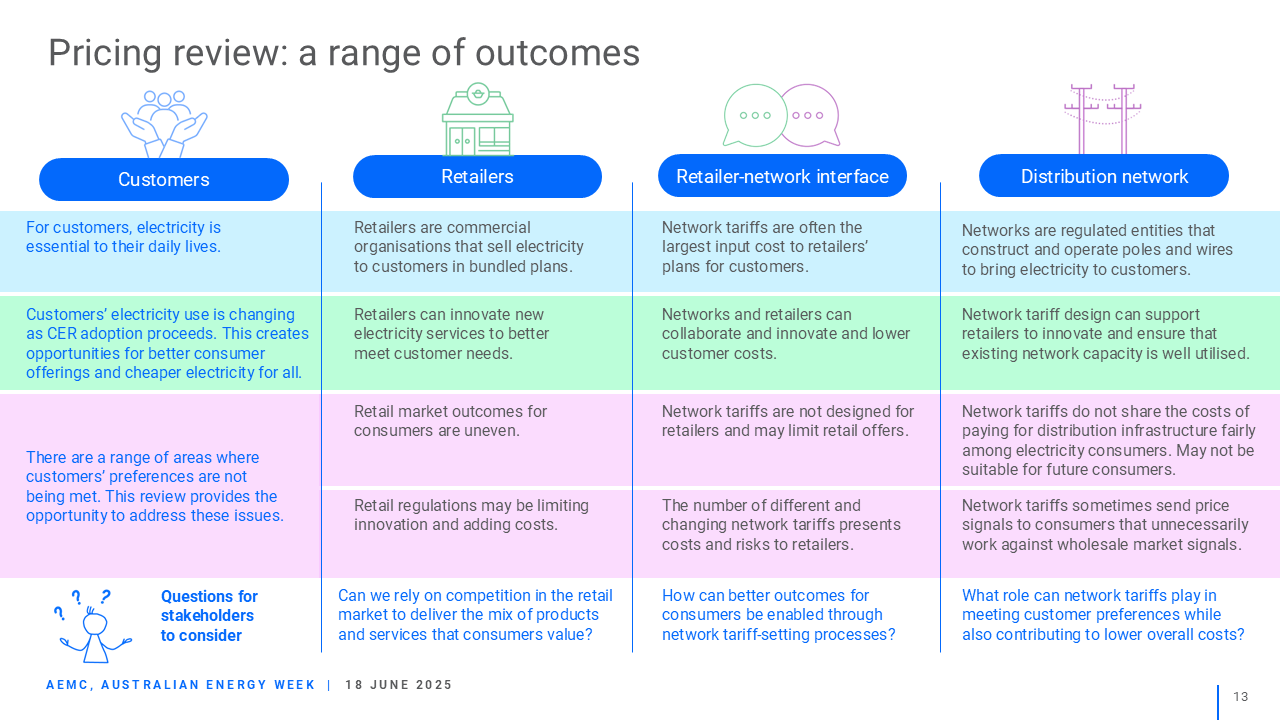

Another busy slide, but the full discussion paper is on our website.

The questions we want to ask are:

First – can retail competition deliver these outcomes for customers, and if not, what is standing in the way? Other workstreams are relevant here, including the Commonwealth-led work looking at whether the customer protection framework continues to be fit for purpose, and how it may need to adapt for new energy services under the Better Energy Customer Experience reforms.

Second – how do retailers and networks work better together to deliver the services customers want? For the technically minded, this could be regarded as whether network tariffs should be designed for customers or for retailers.

And third – are network tariffs doing the job we want them to do – which is to keep the costs of the system down so everyone pays less? More importantly, will they keep doing that in a future world with the levels we expect to see of solar panels, EVs and home batteries?

As I mentioned, the federal battery subsidy looks set to be a game-changer in terms of home storage and discharge capacity, and we want to be prepared for this future rather than letting it creep up on us.

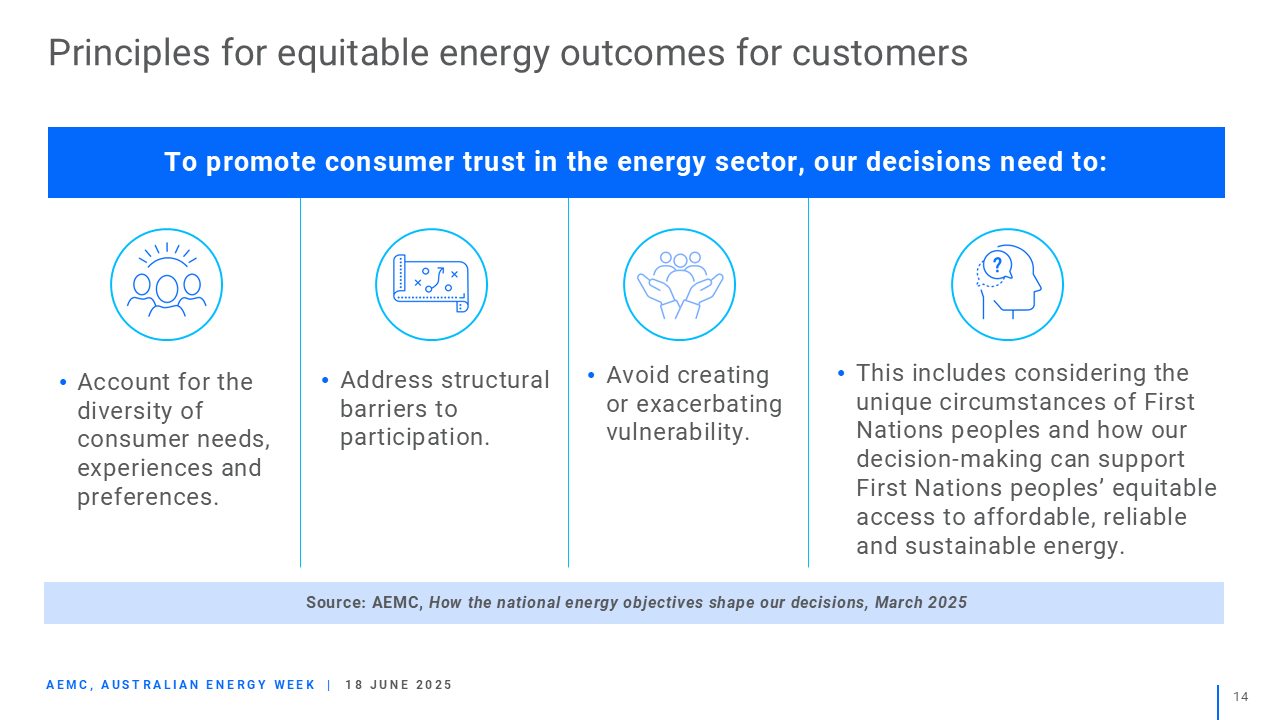

Coming back again to solid principles for making decisions about known unknowns – we are also focusing on equity in this review and across other parts of our work program.

We get calls from time to time for equity to be expressly included in our national energy objectives. We want to be clear about how we can and do take equity into account in the current framework.

Often principles of efficiency and appropriate risk allocation, which are our bread and butter, line up very neatly with equity.

And so, a final question on pricing for now:

In a world of high CER, how do we ensure both an efficient and equitable approach to sharing the costs of the distribution network, recognising both the benefits and challenges of this system of the future?

So, we’re closing submissions on this discussion paper on the 10th of July and I look forward to seeing your response to these questions and more. And if you are attending the policy forum on Friday you can hear my colleague Danielle Beinart cover the review in more detail.

Nelson review

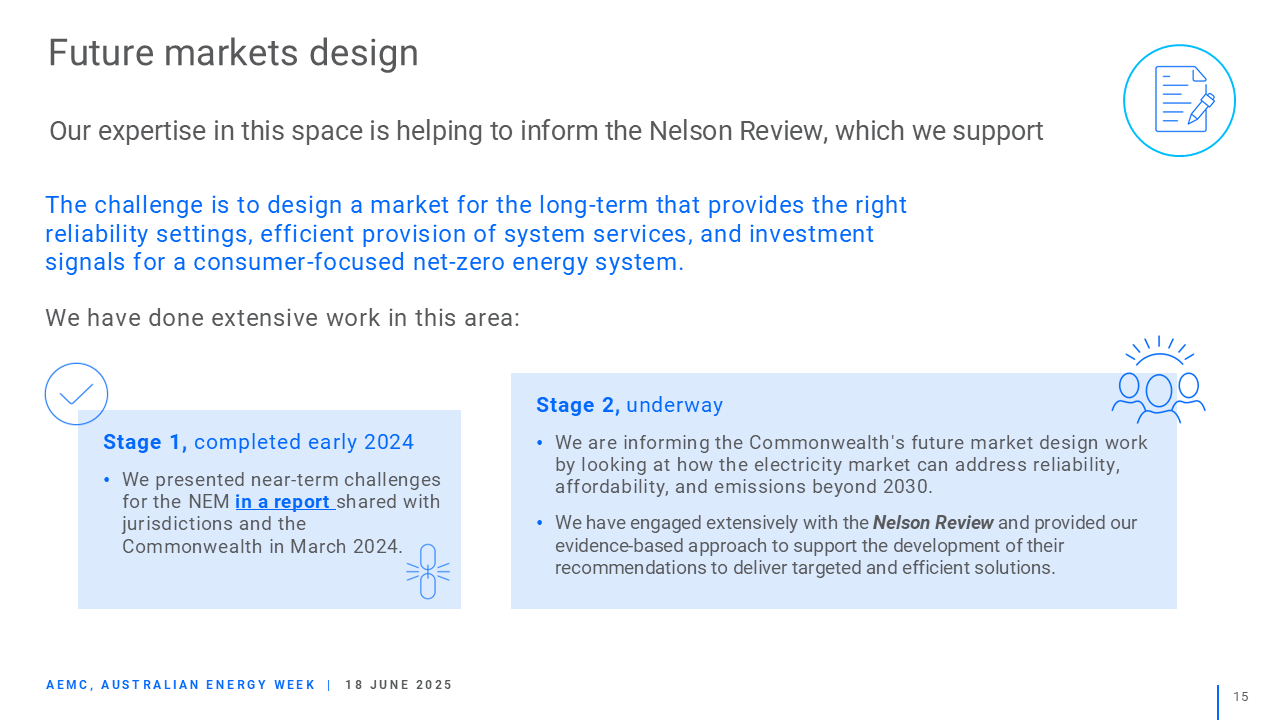

Finally, I have observations about known unknowns in the context of the work underway this year by the independent review into the NEM Wholesale Market Settings.

The AEMC has a significant interest in this piece of work, as, I know, does everyone in this room.

It's an area that has been reviewed constantly across the last 10 years or more. Each new review leverages off a degree of not quite being satisfied by the outcomes of the one that came before.

The question of what mix of assets will deliver the security and affordability we need in the future world is full of known unknowns.

We’re not unique here; these issues were top of mind at my regulatory conference in San Francisco. Everyone around the world is grappling with them.

At the AEMC, we really want this market review to be a success. We put an enormous amount of work into our formal submissions to the independent panel, starting some 18 months before the panel was formally appointed, and have taken every opportunity to engage at all levels with the panel's work.

To grossly simplify our submission down to three points:

we urge the reviewers to build on the strengths of the current market

we hope to see a focus on the investment challenges, and

it’s unlikely that any answer can be a one-size-fits-all approach. In fact, to slip my fashionista beret back on, we think there will be real value in a full range of solutions taking us from day to night: from sportswear through to business casual, along with a few fancy cocktail outfits and some comfortable dressing gowns!

That said, we appreciate the pragmatic way the panel is going about its work and the direction of its thinking.

I’m sure when the draft report is released, there will be areas we agree and disagree with. As a good stakeholder, we’ll put our best foot forward to articulate our views, particularly in any areas of difference.

But as an organisation which is ordinarily on the receiving end of such submissions, we also want to be mindful of two things.

The first is not to waste this chance to make meaningful and positive change on critical issues for the transition.

The second, which was put eloquently by an esteemed academic colleague at an AEMC event last year, is that the intricate work of energy market reform is never done.

Which brings me to another tool for making decisions when there are known unknowns: at the end of the day you just have to exercise judgement because you cannot know how everything will play out.

Our collective wisdom at this point in the transition is pretty high.

We need to be comfortable with embracing a solution that has more right than wrong, and we need to remember that the future will continue to creep towards us and we can continue to evolve.

Conclusion

I only want to say two things in conclusion.

The first is to quote the ancient philosopher Heraclitus, who wrote that you cannot step twice in the same river, capturing the idea that the only constant is change.

The second is that we can worry about the future as much as we like, but we can only act today – today is all we have. And I back that up with a quote from another famous philosopher and, incidentally, a fashionista – Edna Mode from The Incredibles:

I never look back, darling. It distracts from the now.

And with that in mind, and amidst all of the things we know we cannot yet know, my last thought for you today is that sometimes you just have to be brave and to get on with it.

And I look forward to bravely getting on with the energy transition, with all of you.

Thank you.